- December 4, 2024

- By: Admin1_blog

- Asia Market, Indices

Dylan Butts

South Korean markets opened lower Wednesday, after a day of political upheaval in South Korea that saw President Yoon Suk Yeol impose and then lift a martial law decree within hours.

The country’s Kospi index was down 1.9% while the Kosdaq fell 2.1%, in choppy trading amid news of the possible deployment of funds by the country to shore up its markets.

Following an emergency board meeting, the Bank of Korea said it would boost short-term liquidity and deploy measures to stabilize the FX market as required. It will also make available any special loans needed to inject funds into the market, it added.

Earlier, Yonhap News Agency had reported that country’s top financial regulator was ready to deploy 10 trillion won ($7.07 billion) in a stock market stabilization fund at any time to calm market sentiment.

Meanwhile, South Korea’s foreign exchange authorities are suspected of selling U.S. dollars on the onshore market early Wednesday in efforts to limit declines in the Korean won, two dealers told Reuters.

As per local reports, the country’s opposition Democratic Party has said it would begin impeachment proceedings to remove Yoon if he doesn’t step down immediately. Yoon’s chief of staff and senior secretaries have reportedly offered to resign en masse.

Other Asia-Pacific markets were trading lower as investors digested events in South Korea.

Japan’s Nikkei 225 was down 0.4%, while the Topix dropped 0.4%.

Hong Kong’s Hang Seng index was trading 0.1% higher. Mainland China’s CSI 300 dropped 0.2%.

Investors also assessed GDP data out of Australia, which showed economic growth come in slower than expected in the third quarter, as elevated borrowing costs and sticky inflation continued to weigh on the country.

Australia’s S&P/ASX 200 was trading 0.4% lower.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 39254.97 | 6.11 | 0.02 |

| .HSI | Hang Seng Index | *HSI | 19762.8 | 16.48 | 0.08 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 8462.7 | -32.5 | -0.38 |

| .SSEC | Shanghai | *SHANGHAI | 3376.41 | -2.39 | -0.07 |

| .KS11 | KOSPI Index | *KOSPI | 2452.96 | -47.14 | -1.89 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 10171.28 | -4.27 | -0.04 |

In the U.S. overnight, South Korean stocks swung wildly amid the political upheaval that rocked the world’s 13th-largest economy.

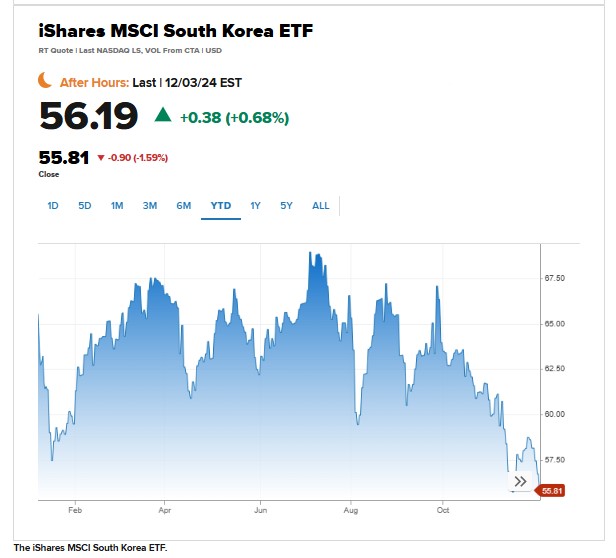

The iShares MSCI South Korea ETF (EWY), which tracks more than 90 large and mid-sized companies in South Korea, tumbled as much as 7% to hit a 52-week low.

Later in the day, the ETF cut losses and closed Tuesday down 1.6% after Yoon said he would lift the emergency declaration following the National Assembly’s vote to overturn his martial law decree.

Meanwhile, the S&P 500 inched up by 0.05%, while the Nasdaq Composite added 0.4%. Both indexes closed at records. The 30-stock Dow was the laggard, with a decline of nearly 0.2%.

— CNBC’s Yun Li and Hakyung Kim contributed to this report.

South Korean may weaken further to 1,450 on the dollar in coming months, strategist says

South Korean won is likely to weaken further to trade at 1,450.0 against the greenback in the coming months, Alvin Tan, head of Asia FX strategy at RBC Capital Markets said in a note on Wednesday, despite the Bank of Korea’s efforts to “try to lean against the pressure.”

“The domestic political turmoil will aggravate the bearish sentiment swirling around the Korean won, though the growth slowdown and likely U.S.-China trade war next year will continue be the bigger driver,” Tan added.

Reuters reported earlier that South Korean financial exchange authorities were suspected of selling U.S. dollars on the onshore market early on Wednesday morning as it attempted to limit declines in the Korean won.

The South Korean won last traded at 1,416.94 on the dollar on Wednesday, recovering from a sharp fall overnight that sent the won to its weakest level since late 2022.

— Anniek Bao

Kospi heavyweight stocks fall in volatile trade after President Yoon’s martial law flip-flop

South Korean heavyweight stocks fell in a volatile trading session Wednesday amid political upheaval that saw President Yoon Suk Yeol reverse a surprise martial law decree that he imposed hours earlier.

Minutes before the markets opened, Kim Byung-hwan, vice-minister of economy and finance, said the regulator was ready to deploy 10 trillion won ($7.07 billion) to stabilize the stock market “at any time,” local media Yonhap reported.

South Korean chipmaking giant Samsung Electronics saw shares drop nearly 1% while battery-maker LG Energy Solution and automaker Hyundai Motor experienced wider losses of 2.8% and 2.4%, respectively.

Chip major SK Hynix was marginally lower in choppy trading. Internet giant Naver Corp and battery manufacturer Samsung SDI saw shares sink over 2.5%.

Korea Gas Corporation led the declines in the Kospi index, falling over 14%.

— Anniek Bao

Amid political chaos, Bank of Korea says it will boost short-term liquidity and deploy measures to stabilize the FX market

The Bank of Korea said Wednesday that it would boost short-term liquidity and deploy measures to stabilize the FX market as needed, after South Korean President Yoon Suk Yeol lifted a surprise martial law declaration overnight.

The announcement came shortly after the BOK held an emergency board meeting, which started around 9 a.m. local time. In a statement issued after the meeting, the central bank said it will also make any special loans available to inject funds into the market, if needed.

“As announced together with the government, we will provide sufficient liquidity for a limited time until the financial and foreign exchange markets stabilize,” the Bank of Korea said, reiterating a pledge made earlier in the day by South Korea Finance Minister Choi Sang-mok.

Local news agency Yonhap reported earlier Wednesday that South Korea’s financial regulator said it is prepared to allocate 10 trillion won ($7.07 billion) to a stock market stabilization fund at any time.

— Lee Ying Shan

President Yoon’s martial law decision was poor and hits South Korea at a bad time: Economist

President Yoon’s martial law decision is poor and hits South Korea at a bad time

South Korea’s President Yoon Suk Yeol’s declaration and later walk back of martial law hits South Korea at a bad time for the economy said Trinh Nguyen, senior economist at Natixis.

Speaking to CNBC’s “Squawk Box Asia,” Nguyen noted that South Korea’s economy was already grappling with weak domestic demand, contracting exports and a downward cycle in its semiconductor market.

“We really need a strong government to have a budget that is fiscally supportive, not just for the short term, but a longer term to deal with a lot of challenges,” she said, citing economic troubles in China and potential tariffs from the U.S.

— Dylan Butts

China’s services sector growth slows, Caixin PMI Shows

China’s service sector growth slowed in November, according to a Caixin-sponsored survey published Wednesday, as deflationary pressures continue to weigh on the economy.

China’s Caixin Services Purchasing Managers’ Index (PMI) dropped to 51.5 for the month of November from 52.0 the month prior, according to the survey.

Services business confidence rebounded to its highest level since April, while employment grew for a third successive month.

— Dylan Butts

Australia third-quarter GDP grows at 0.3%, missing expectations

Australia’s economy grew at slower than expected in the third quarter, as elevated borrowing costs and sticky inflation continued to weigh down on the slowing economy.

The real gross domestic product rose 0.3% in the three months through September compared with 1% in the previous quarter, according to the Australian Bureau of Statistics said on Wednesday. That also missed the Reuters forecast of a 0.4% jump.

On an annualized basis, Australia’s economy rose 0.8%, also missing Reuters estimate of a 1.1% growth, following a 1% rise in the 12 months through the previous quarter.

The country’s economy has been on a slowing trend for the past two years, as the Reserve Bank of Australia embarked on a tightening campaign that saw it raise the interest rates by whopping 425 basis points since May 2022.

— Anniek Bao

Bank of Korea holds emergency meeting after Yoon lifts martial law

The Bank of Korea is holding an emergency meeting after South Korean President Yoon Suk Yeol lifted a surprise martial law declaration overnight.

The central bank was set to convene an extraordinary board meeting at around 9 a.m. local time on Wednesday. Last week, the BOK cut its benchmark interest rate by 25 basis points in a surprise move.

Around that time, local news agency Yonhap reported that South Korea’s regulator financial regulator said it is prepared to allocate 10 trillion won ($7.07 billion) to a stock market stabilization fund any time.

—Lee Ying Shan

CNBC Pro: ‘We really like the U.S.’ Julius Baer portfolio manager says. Here’s where she sees opportunity

At a time when investors are mixed on the U.S. market, one portfolio manager remains optimistic and sees reason to stay invested over the longer-term.

“We really like the U.S. Now that the election result is clear and behind us, we can reasonably assume a higher growth rate in the U.S., and that’s probably going to lead to an end of year rally,” Aneka Beneby, portfolio manager at Julius Baer International said, revealing segments she sees opportunities in.

— Amala Balakrishner

CNBC Pro: How are investors trading France’s political chaos?

The French government is on the brink of collapse this week and investors are gearing up for a volatile week of trading, with some eyeing opportunities amid the chaos.

Investors have shared how they’re trading French bonds and laid out what could happen if the government falls, and other scenarios.

— Ganesh Rao

S&P 500, Nasdaq close at fresh record highs

The S&P 500 and Nasdaq Composite closed at new records on Tuesday.

The broad market index advanced 0.05% to close at 6,049.88, and the tech-heavy Nasdaq gained 0.4% to close at 19,480.91. Meanwhile, the blue-chip Dow Jones Industrial Average slid 76.47 points, or 0.17%, to finish at 44,705.53.

— Sean Conlon

EWY shares fall as South Korean president declares martial law

The iShares MSCI South Korea ETF (EWY) slipped more than 4% on Tuesday, after President Yoon Suk Yeol accused the country’s opposition party of controlling parliament and supporting North Korea.

— Brian Evans

Korean won tumbles against greenback

The Korean won weakened 1.2% against the dollar to its lowest level in two years on the news that South Korean President Yoon Suk Yeol declared “emergency martial law” on Tuesday.

The dollar last traded at 1,421.29 won.

Source : cnbc