- May 30, 2024

- By: Admin1_blog

- Asia Market, Indices

Shreyashi Sanyal & Lim Hui Jie

Asia-Pacific markets extended losses on Thursday, tracking Wall Street’s moves ahead of a slew of economic data from the region on Friday.

Japan’s Nikkei 225 fell about 1.6%, while the broader Topix dropped 0.8%. South Korea’s Kospi shed 0.72%, and the smaller cap Kosdaq slipped 0.3%.

Japan and South Korea will release industrial production figures on Friday, and China will release the official purchasing managers index for May. Inflation data for Japan’s capital city of Tokyo will also be released. Australia’s S&P/ASX 200 extended declines from the previous session and fell 0.42%. Miners in Australia led the declines. Hong Kong’s Hang Seng index and mainland China’s CSI 300 index were trading near the flatline.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38037.42 | -519.45 | -1.35 |

| .HSI | Hang Seng Index | *HSI | 18213.73 | -263.28 | -1.42 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7629.9 | -35.7 | -0.47 |

| .SSEC | Shanghai | *SHANGHAI | 3092.85 | -18.17 | -0.58 |

| .KS11 | KOSPI Index | *KOSPI | 2642.13 | -35.17 | -1.31 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9504.51 | -115.9 | -1.2 |

Overnight in the U.S., all three major indexes fell, pressured by rising Treasury yields. The 10-year Treasury note yield ticked higher for a second day, last trading above 4.6%.

Higher yields can lower the multiples investors are willing to pay for stocks, drive up borrowing costs, hurt consumer spending and make T-bills and money market funds more attractive.

The Dow Jones Industrial Average fell 1.06%, while the S&P 500 dipped 0.74%, marking its first negative session of the previous three. The Nasdaq Composite slipped 0.58%, as Nvidia’s advance mitigated losses for the technology-heavy index.

— CNBC’s Alex Harring and Pia Singh contributed to this report.

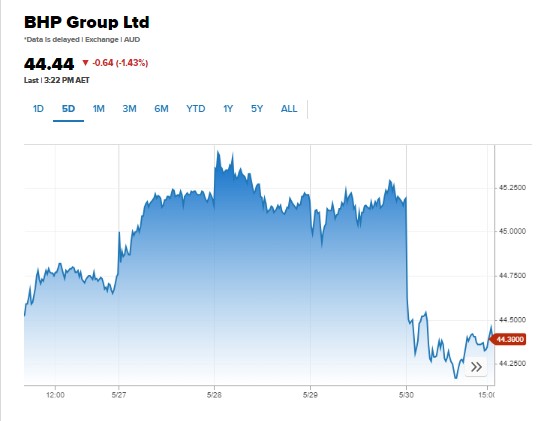

Australian miners slip as BHP walks away from Anglo American takeover plan

Shares of Australian miners fell after mining giant BHP walked away from its £38.6 billion ($49 billion) plan to take over rival Anglo American.

In a regulatory filing, BHP said that while it believed that its takeover bid was “a compelling opportunity to effectively grow the pie of value for both sets of shareholders,” it was unable to reach agreement with Anglo American, specifically in respect of South African regulatory risk and cost.

BHP had made two earlier offers at £31.1 billion in April, and a £34 billion offer on May 14.

Shares of BHP lost 1.73%, while counterparts Rio Tinto and Fortescue Group dropped 1.34% and 2.27% respectively.

— Lim Hui Jie

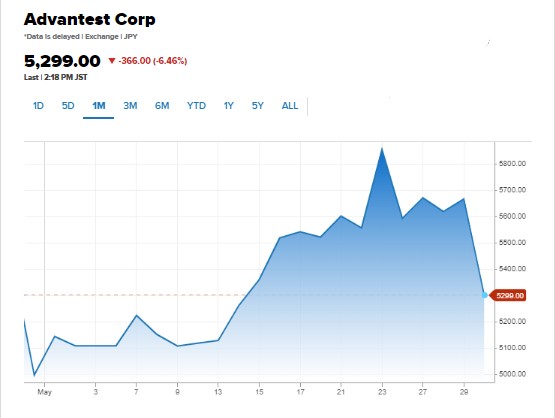

Nikkei falls more than 2% on open, dragged by consumer cyclical and industrial stocks

Japan’s Nikkei 225 fell more than 2% on its open on Thursday, dragged lower by health-care, consumer cyclical and industrial stocks.

The largest loser on the index was semiconductor equipment firm Advantest, which fell 5.8%.

Mitsubishi Electric, the electrical manufacturing subsidiary of heavyweight trading house Mitsubishi, fell by nearly 5%. Other top losers include Tokyo Electric Power Company which fell 4.7% and medical device maker Terumo, which lost 4.25%.

— Lim Hui Jie

CNBC Pro: Goldman Sachs names global ‘alpha’ stock ideas — and gives one nearly 60% upside

European markets have largely had a good run this year — with several market watchers looking keenly at the region and saying that it has “greater tailwind than the U.S.”

Those searching for pockets of opportunities in the region can look to Goldman Sachs’ selection of “alpha” stock opportunities.

“Our macro team expects solid growth and monetary policy easing into 2H24. While the YTD [year-to-date] rally in equities suggests some of this optimism is already priced, with market correlation at a 5-year low, we continue to see potential for alpha opportunities,” the investment bank’s analysts noted, naming stocks they see potential in.

— Amala Balakrishner

CNBC Pro: This global fund’s stock could rally by 50% if buyback limits are removed, fund manager says

A global investment trust based in the United Kingdom could see its stock price soar by more than 50% if restrictions on share buybacks are lifted, according to fund manager Brian McCormick.

The company, which trades on the London Stock Exchange, says it has assets worth £3 billion ($3.8 billion) and holds investments in private companies as well as publicly listed companies.

— Ganesh Rao

Hedge fund exposure to “Magnificent 7” rises to record high

Hedge funds are continuing to add to their bets on Big Tech stocks, according to a note from Goldman Sachs prime brokerage.

“The Magnificent 7 stocks collectively now make up 20.7% of total U.S. single stock Net exposure, the highest level on our record and exceeding the previous peak level of 20% seen last summer,” the note said.

The higher exposure was helped by the recent outperformance of Nvidia, which surged 9% last Thursday on a day when the S&P 500 declined.

— Jesse Pound

Fed reports economy expanded despite concerns over inflation

The U.S. economy grew unevenly over the past six weeks while consumers recoiled against higher prices, the Federal Reserve reported Wednesday.

As part of its periodic “Beige Book” economic look, the Fed noted that the economy “continued to expand” during the period, though “conditions varied” among the 12 central bank districts.

On inflation, the report said prices rose at a “modest” pace while “consumers pushed back against additional price increases, which led to smaller profit margins as input prices rose on average.” Retailers reported offering incentives to shoppers as “price growth is expected to continue at a modest pace in the near term.”

— Jeff Cox

JPMorgan CEO Jamie Dimon reiterates succession plan timeline

JPMorgan Chase Chair and CEO Jamie Dimon stood by comments from last week that his retirement from the storied Wall Street firm could be less than five years away.

″[T]he timetable is less than five years, and you know, that could be four, be three, be three and a half, four and a half, it could be two and a half. It’s up to the board,” Dimon said in response to questions at Bernstein’s Strategic Decisions Conference on Wednesday. “The board will decide, we’ve got some great succession. You will know them all. So you should evaluate that yourself.”

— Ritika Shah, Brian Evans

Source : cnbc