- June 5, 2024

- By: Admin1_blog

- Asia Market, Indices

Shreyashi Sanyal & Lim Hui Jie

Asia-Pacific markets were mixed on Wednesday, with stocks in India stabilizing after a heavy sell-off in the previous session as investors assessed India’s election results.

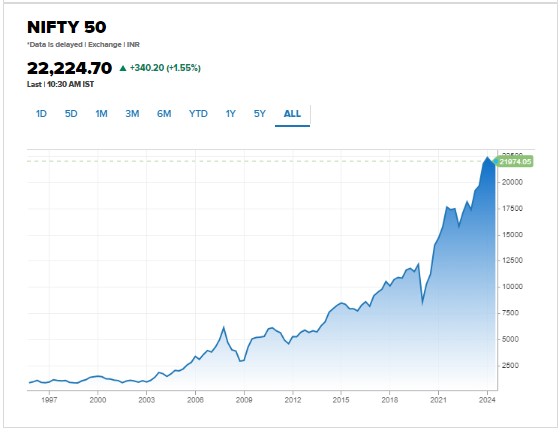

The Nifty 50 index edged 0.61% higher and the BSE Sensex added 0.75%.

The Nifty 50 plunged 5.93% on Tuesday, and the Sensex lost 5.74%, marking their sharpest fall since 2020 after Prime Minister Narendra Modi’s Bharatiya Janata Party fell short of an outright majority in the lower house of parliament.

The All India Market Capitalization index, tracked on the Bombay Stock index, lost over 31.06 trillion rupees, or about $371 billion on June 4.

Modi is still set for a third term in power after the BJP-led National Democratic Alliance secured 294 seats, more than the 272 needed for the coalition to form the government.

Elsewhere, first-quarter gross domestic product from Australia came in at 1.1% year-over-year, slightly below a Reuters poll expectation of 1.2%.

Australia’s S&P/ASX 200 edged 0.45% higher. However, Japan’s Nikkei 225 dropped 1.07%, while the broader Topix shed 1.42%. South Korea’s Kospi rose 1.13%, while the smaller-cap Kosdaq rose 0.45%. Hong Kong’s Hang Seng index rose 0.33%, while mainland China’s CSI 300 index dipped 0.33%.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38387.08 | -450.38 | -1.16 |

| .HSI | Hang Seng Index | *HSI | 18521.99 | 77.88 | 0.42 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7767.1 | 30 | 0.39 |

| .SSEC | Shanghai | *SHANGHAI | 3074.76 | -16.44 | -0.53 |

| .KS11 | KOSPI Index | *KOSPI | 2695.06 | 32.96 | 1.24 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9654.93 | 8.3 | 0.09 |

Overnight in the U.S., the Dow Jones Industrial Average rose as Wall Street sought its footing after an uneven start to the month.

The 30-stock Dow climbed 0.36%, while the S&P 500 added 0.15% and the Nasdaq Composite advanced 0.17% to 16,857.05.

Treasury yields were notably lower, with the rate on the benchmark 10-year note slipping about 7 basis points.

— CNBC’s Brian Evans and Jesse Pound contributed to this report.

India stocks steady after massive falls after election results

India stocks steadied a day after benchmark indexes saw their biggest one-day fall in four years as the electoral performance of Prime Minister Narendra Modi’s ruling Bharatiya Janata Party fell short of expectations.

The Nifty 50 index edged 0.59% higher and the BSE Sensex added 0.75%.

The Nifty 50 and the Sensex lost 5.93% and 5.74% on Tuesday, marking their largest loss since 2020. India markets lost over 31.06 trillion rupees, or about $371 billion, according to the All India Market Capitalization index.

— Shreyashi Sanyal, Lim Hui Jie

Australia first quarter GDP narrowly misses expectations

Australia’s economy grew 1.1% year on year in the first quarter, slowing from a revised fourth quarter growth figure of 1.6%.

The 1.1% growth also was slightly below a Reuters poll expectation of 1.2%. On a quarter on quarter basis, Australia’s GDP rose 0.1%, less than the 0.2% expected in the Reuters poll.

Katherine Keenan, head of national accounts at the Australian bureau of statistics noted that “GDP growth was weak in March, with the economy experiencing its lowest through the year growth since December 2020.”

— Lim Hui Jie

China services activity grows at fastest pace in 10 months, private survey shows

China’s services activity grew at the fastest pace in 10 months in May, according to a private survey.

The Caixin S&P Global services purchasing managers’ index rose to 54 from 52.5 in April, growing at the quickest pace since July 2023.

A PMI reading above the 50-mark separates expansion from contraction.

The survey also showed that incoming new work increased at the fastest pace since May 2023.

— Shreyashi Sanyal

Japan real wages fall for 25th straight month

Real wages in Japan fell for a 25th straight month in April, potentially stifling the Bank of Japan’s plans to raise interest rates and realize its “virtuous cycle” of increasing wages and prices.

Government data showed that real wages fell 0.7%, a softer fall from the 2.1% loss in March. Nominal wages came in at 296,884 yen ($1,913.28), growing 2.1% year on year.

This accelerated from March’s nominal wage growth of 1%, posting its highest pace of growth in 10 months.

— Lim Hui Jie

CNBC Pro: The super-rich are moving cash to one city, wealth manager says, revealing how they’re investing

The growth prospects of countries like India and South Korea have seen many investors and big-name banks turn bullish on emerging markets this year. One wealth manager, however, said his super-rich clients are focused elsewhere.

Dhruba Jyoti Sengupta, CEO of Wrise Private Middle East, said “a lot of wealth — especially from ultra-high-net-worth individuals — is moving” to the city.

He also revealed how individuals with around $10 million to invest typically allocate funds.

— Amala Balakrishner

CNBC Pro: Beyond Nvidia: Fund manager names stocks set to reap returns from AI investments

Nvidia is one obvious beneficiary of artificial intelligence — companies have been buying its chips and investor interest has sent its shares soaring to record highs.

Many companies are in the AI infrastructure buildout phase right now. But will their millions to billions dollars’ worth of investments pay off?

Clare Pleydell-Bouverie, portfolio manager at Liontrust Asset Management, weighs in.

— Weizhen Tan

Stocks falling alongside Treasury yields a red flag for investors, Rosenberg says

Tuesday’s moves, albeit muted, should raise some concern for investors, according to Rosenberg Research founder David Rosenberg.

“The fact that equities are not responding well to the renewed pullback in Treasury yields and the swaps market beginning to price in a September rate cut is signaling something important: that stock market investors are also becoming concerned about the economic slowdown and what it means for the earnings outlook,” Rosenberg said in a post on social media site X.

The S&P 500 traded 0.2% lower Tuesday afternoon, while the benchmark 10-year Treasury yield slid 7 basis points to 4.3%.

— Fred Imbert

Market doesn’t need rate cuts to go up, says Deutsche Bank’s Chadha

The market does not need rate cuts to rally, according to Deutsche Bank’s Binky Chadha.

“I don’t think that we need rate cuts for the market to go up,” the chief global strategist told CNBC’s “Squawk on the Street” on Tuesday. “House view is for one cut, but all the way in December.”

The firm remains “constructive equities,” he added.

— Samantha Subin

BofA sees biggest net sale of U.S. equities by clients since July 2023

Bank of America Securities clients were net sellers of U.S. equities last week, with tech stocks taking the biggest hit, according to the bank.

Overall, equities and tech stocks both logged their largest outflows since last July, analyst Jill Carey Hall wrote in a note Tuesday. It was the fourth-largest outflow for overall equities in Bank of America’s history since 2008. Tech stocks saw their second-largest outflow since 2008.

Institutional and hedge fund clients were net sellers, while retail clients were net buyers, she said. The sell-off was led by large/mid-caps, while clients bought small caps.

Clients also sold equity exchange-traded funds for the second week in a row, led by small-cap ETFs and blend/growth ETFs, Hall said. Clients bought large/mid/broad market and value ETFs, she said.

— Michelle Fox

Source : cnbc