- February 3, 2025

- By: Admin1_blog

- EU Market, Indices

Holly Ellyatt

European markets are expected to open sharply lower Monday after U.S. President Donald Trump imposed trade tariffs on several countries and threatened to do the same with the European Union and U.K.

The U.K.’s FTSE 100 index is expected to open 116 points lower at 8,563, Germany’s DAX down 498 points at 21,217, France’s CAC down 166 points at 7,772 and Italy’s FTSE MIB down 901 points at 35,708, according to data from IG.

European markets are set to react negatively to President Trump’s decision at the weekend to slap 25% tariffs on imports from Mexico and Canada and a 10% levy on goods from China. The tariffs are set to come into effect Tuesday. The U.S. does about $1.6 trillion in business with the three countries.

Canada has retaliated with its own sanctions on U.S. imports and Mexico has threatened to do the same.

When asked on Sunday about the prospect of tariffs on goods from the U.K. and European Union, Trump told the BBC that both were “out of line” but that the EU was worse. He said a deal could be “worked out” with the U.K., a country with whom the U.S. has a more balanced trade relationship.

Trump described the U.S. trade deficit with the EU as an “atrocity,” repeating his previous comments that the bloc had “really taken advantage” of the United States. Officials from the EU signaled previously that the bloc could respond to any future U.S. tariffs “in a proportionate way.”

Asia-Pacific markets traded lower overnight after Trump’s tariff move, while U.S. stock futures tumbled Sunday night as investors weighed new U.S. tariffs and their potential impact on the economy and corporate profits.

Earnings in Europe come from Julius Baer on Monday, while data releases include the latest euro zone inflation data.

Julius Baer net profit jumped 125% in 2024

Swiss wealth manager Julius Baer on Monday reported full-year net profit of 1.02 billion Swiss francs ($1.12 billion) — a year-on-year increase of 125%.

A year earlier, the bank reported a net profit of 454 million Swiss francs. Its exposure to real estate group Signa Holding led to a net credit loss of 606 million Swiss francs in 2023, which led to the resignation of then-CEO Philipp Rickenbacher.

The company said on Monday that its assets under management hit a record high last year, rising 16% year on year to 497 billion Swiss francs. It attributed the rise to new net money, rising stock markets and a weaker Swiss franc.

Earnings per share came in at 4.98 Swiss francs.

— Chloe Taylor

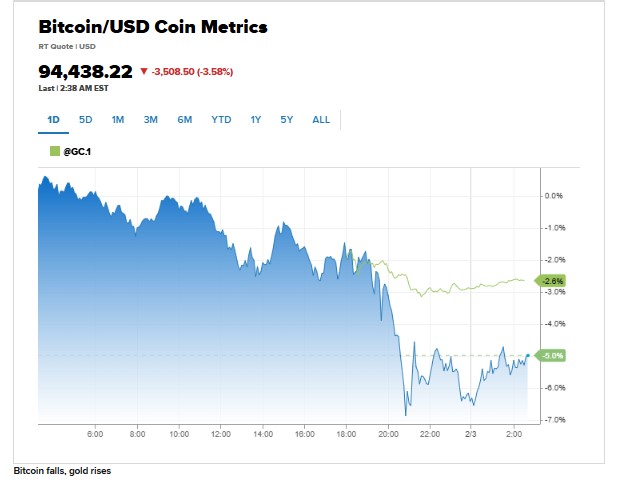

Bitcoin falls, gold rises in risk-off move after U.S. tariffs

Traders appeared to search for safety in early Sunday night trading after the U.S. hit key trade partners with hefty tariffs on goods.

Bitcoin dipped back below $100,000, losing 3.6% to trade at $97,554.24. Gold, a traditional safe-haven asset, ticked 0.3% higher to $2,842.60 per ounce.

— Fred Imbert

Canada, Mexico, China and Europe respond to Trump tariffs

The U.S. on Saturday imposed levies on imports from Canada, Mexico and China. Here’s how those countries, and the European Union, reacted:

- Canada: Prime Minister Justin Trudeau slapped retaliatory tariffs of 25% on $155 billion worth of U.S. goods. “Like the American tariffs, our response will also be far-reaching and include everyday items such as American beer, wine and bourbon, fruits and fruit juices, including orange juice, along with vegetables, perfume, clothing and shoes,” Prime Minister Justin Trudeau said.

- Mexico: President Claudia Sheinbaum slammed the new levies, saying she instructed the country’s secretary of the economy to “implement the Plan B we have been working on, which includes tariff and non-tariff measures in defense of Mexico’s interests.”

- China: The country said it would file a lawsuit with the World Trade Organization. “The U.S.’s unilateral tariff hike seriously violates WTO rules, does nothing to resolve its own issues, and disrupts normal economic and trade cooperation between China and the U.S.,” the Chinese Ministry of Commerce said in a statement Sunday, according to an NBC translation.

- The European Union: A spokesperson for the EU said the bloc would “respond firmly” if President Donald Trump imposed tariffs on the region. “Across-the-board tariff measures raise business costs, harm workers and consumers. Tariffs create unnecessary economic disruption and drive inflation. They are hurtful to all sides,” the spokesperson said.

— Katrina Bishop

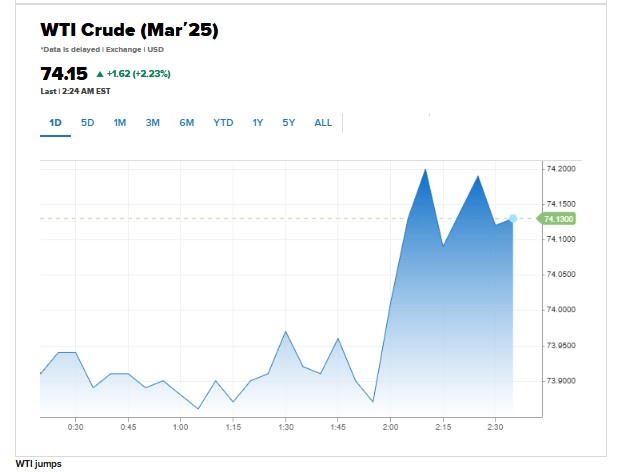

Oil prices pop after U.S. hits Mexico, Canada and China with tariffs

Oil prices began Sunday trading higher after the U.S. slapped tariffs on goods from China, Canada and Mexico — all key trading partners.

West Texas Intermediate futures were up 2% at $74.20 per barrel. International Brent crude climbed 1% to $76.42 per barrel.

— Fred Imbert

U.S. dollar edges 1% higher after Trump tariffs

The U.S. dollar advanced nearly 1% on Sunday night, continuing gains since President Donald Trump implemented tariffs over the weekend. The currency is trading near five-year highs.

— Pia Singh

European markets: Here are the opening calls

European markets are expected to open sharply lower Monday after U.S. President Donald Trump imposed trade tariffs on several countries and threatened to do the same with the European Union and U.K.

The U.K.’s FTSE 100 index is expected to open 116 points lower at 8,563, Germany’s DAX down 498 points at 21,217, France’s CAC down 166 points at 7,772 and Italy’s FTSE MIB down 901 points at 35,708, according to data from IG.

Earnings come from Julius Baer on Monday, while data releases include the latest euro zone inflation data.

— Holly Ellyatt

Source : cnbc