- March 5, 2025

- By: Admin1_blog

- EU Market, Indices

Jenni Reid & Holly Ellyatt

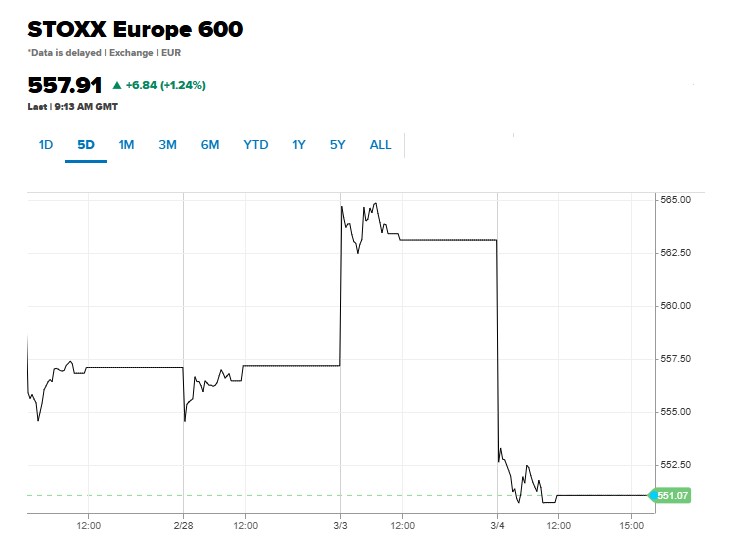

European stocks opened higher Wednesday amid optimism that U.S. President Donald Trump’s 25% duties on Canada and Mexico could be relaxed, with investors also paying close attention to the potential reform of German fiscal rules to allow higher defense and infrastructure spending.

The Stoxx 600 index was 1.16% higher at 9:10 a.m. U.K. time, following the broad downturn in global equities on Tuesday on tariff concerns. The Stoxx autos index, which tumbled nearly 6% in the previous session, rebounded by 2.3%. Utilities and food and beverage were among the sectors in the red.

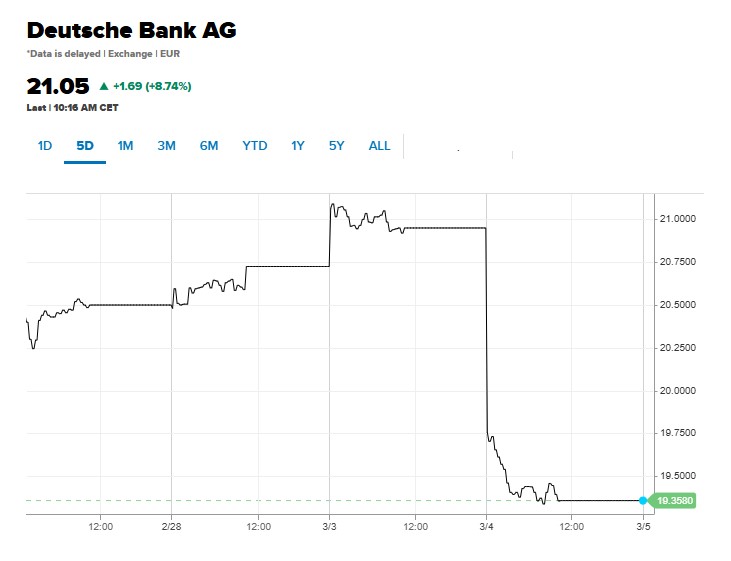

German stocks were the top performers regionally, with Frankfurt’s DAX index up nearly 3%. Top gainers included construction firm Hochtief, up 15.7%, manufacturer Kion Group, up 14.4%, the country’s biggest lender Deutsche Bank, up 8.9%, and Siemens Energy, up 8.2%. Regional defense names also continued their recent rally, with the Stoxx Aerospace and Defense index rising 3.5%.

On Tuesday, Germany’s conservative alliance and the Social Democratic Party — the two groups expected to form the next coalition government following last month’s election — agreed to try to reform the constitutional debt brake system in order to enable defense spending in excess of 1% of GDP. Friedrich Merz, widely billed as likely to become the next chancellor of Europe’s largest economy, said they would also seek to create a 500 billion euro ($529 billion) credit-financed special infrastructure fund over ten years.

Alterations or exemptions to the debt brake system have been seen as crucial as a way to allow fiscal loosening to boost Germany’s struggling economy and increase military spending. The step remains politically contentious.

The yield on German 10-year bonds, seen as the euro zone benchmark, jumped more than 21 basis points to 2.697% at 7:59 a.m. London time. The 2-year yield was 14 basis points higher.

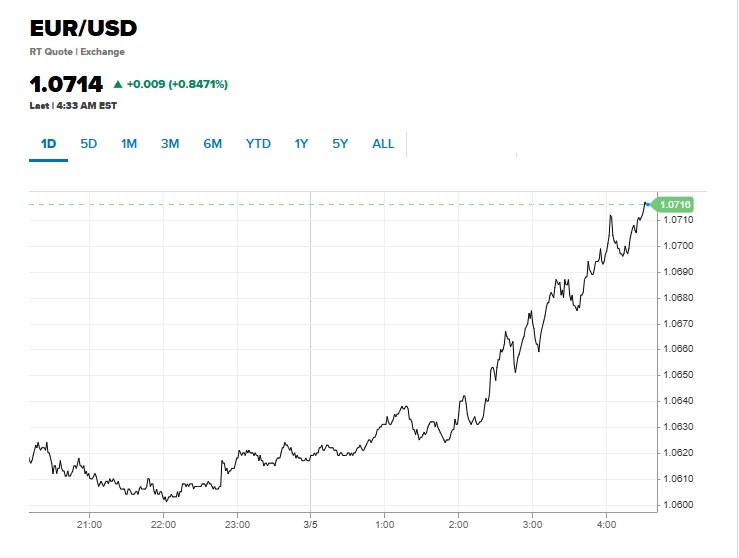

The euro extended its late Tuesday gains by another 0.72% against the U.S. dollar.

Euro/U.S. dollar.

“At this stage, it looks as if Germany will run budget deficits comfortably over 3% of GDP over the next couple of years rather than keeping the deficit at around 2.5% as we had previously assumed,” Andrew Kenningham, chief Europe economist at Capital Economics, said in a Tuesday note.

He said the German announcement showed Merz was “prepared to act decisively” on the economy, but that the additional borrowing that will be needed to finance the extra spending would put upward pressure on Bund yields.

Elsewhere, the introduction of fresh U.S. tariffs has been rattling global market sentiment amid concerns they will reignite inflation and escalate a global trade war.

Wall Street has seen two days of declines as 25% duties on Canada and Mexico went into effect on Tuesday, as well as an additional 10% tariff on Chinese goods. All three countries have announced retaliatory measures.

U.S. stock futures rose overnight, however, after U.S. Commerce Secretary Howard Lutnick said Trump “probably” will announce tariff compromise deals with Canada and Mexico on Wednesday.

European banking sector heats up, with German lenders leading gains

Shares of Germany’s largest lenders perked up in early Wednesday trading, amid news of a potential debt policy overhaul in Europe’s biggest economy and positive momentum across the broader European banking sector.

The European banking index was up 3.21% at 8:42 a.m. London time, with Deutsche Bank up 9.13% and Commerzbank 6.98% higher. Outside of the European Union, stock of British bank Barclays added 6.77%.

Germany’s Friedrich Merz, widely expected to step in as the country’s next chancellor following February elections, on Tuesday announced plans for potential reform to loosen the country’s so-called debt brake fiscal policy on borrowing to allow higher defense spending — in a move that rippled into gains for Germany’s DAX and German bond yields early on Wednesday.

Deutsche Bank share price.

— Ruxandra Iordache

Europe stocks open higher, led by Germany

European stock markets opened higher Wednesday, with Germany’s DAX index jumping 2.8% after the parties expected to form the next government agreed a deal that could lead to increased spending on infrastructure and defense.

France’s CAC 40 and the U.K.’s FTSE 100 were 1.8% and 0.5% higher, respectively, with the pan-European Stoxx 600 index up by 1.2%.

Stoxx 600 index.

— Jenni Reid

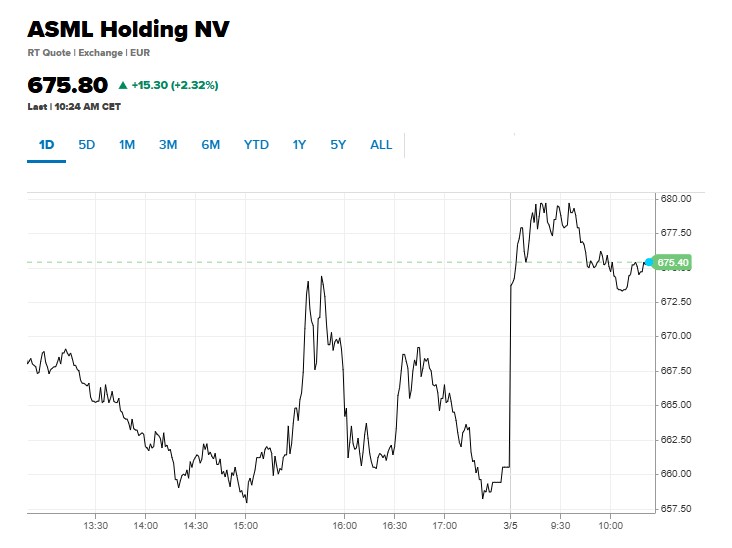

Chip giant ASML says its customers were ‘cautious’ in 2024, flags coming AI boost

Dutch semiconductor equipment maker ASML said in its annual report Wednesday that macroeconomic uncertainty had “led certain customers to remain cautious and control capital expenditure and cash flow more carefully in 2024.”

It also said geopolitical uncertainties had disrupted its supply chain because of reduced material availability and rising prices, and that inflationary pressures had hit its suppliers.

The report meanwhile calls artificial intelligence a “key driver for growth in the semiconductor industry,” but one creating shifts in market dynamics that was not benefiting all its customers equally, creating both opportunity and risk.

“Geopolitical announcements regarding export control restrictions and customer capital expenditure cuts created volatility in the investment community,” the company said.

ASML in January reported a rise in full-year 2024 net sales to 28.2 billion euros ($30 billion) from 27.5 billion euros, and a dip in net income to 7.6 billion euros from 7.8 billion euros.

ASML share price.

— Jenni Reid

Adidas sales rise 19% in the fourth quarter, beating expectations

Adidas on Wednesday reported an uptick in fourth-quarter sales that exceeded expectations, as the retailer shakes off weakness in North America and China demand.

The German sportswear giant recorded a 19% increase revenues at neutral currency rates to 5.97 billion euros ($6.34 billion) in the three-month period, ahead of the 5.72 billion euros forecast by LSEG analysts.

Operating profit came in at 57 million euros in the fourth quarter compared to a loss of 377 million euros in the same period of last year.

— Karen Gilchrist

European markets: Here are the opening calls

European markets are expected to open higher Wednesday.

The U.K.’s FTSE 100 index is expected to open 56 points higher at 8,806, Germany’s DAX up 416 points at 22,733, France’s CAC 146 points higher at 8,176 and Italy’s FTSE MIB 403 points higher at 38,282, according to data from IG.

Earnings come from Sandoz on Wednesday, while data releases include finalized European services and manufacturing activity and Italian quarterly growth data.

— Holly Ellyatt

Source : cbnc.com