- October 9, 2024

- By: Admin1_blog

- Asia Market, Indices

Lim Hui Jie

Chinese stocks sold off in another volatile day of trading amid mixed Asia-Pacific markets Wednesday.

The mainland CSI 300 dropped 4.4%, while Hong Kong’s Hang Seng index climbed 0.7% in a volatile session. On Tuesday, the HSI recorded its worst day in 16 years, closing 9.41% lower.

Japan’s Nikkei 225 climbed 0.95%, while the broad-based Topix gained 0.29%.

Australia’s S&P/ASX 200 was up 0.13%, closing at 8,187,4.

Investors are focused on policy decisions from the Reserve Bank of New Zealand and the Reserve Bank of India.

New Zealand’s central bank slashed its policy rate by 50 basis points to 4.75%, while the RBI held rates at 6.5%.

South Korea’s markets are closed for a public holiday.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 39277.96 | 340.42 | 0.87 |

| .HSI | Hang Seng Index | *HSI | 20976.79 | 50 | 0.24 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 8187.4 | 10.5 | 0.13 |

| .SSEC | Shanghai | *SHANGHAI | 3336.82 | -152.96 | -4.38 |

| .KS11 | KOSPI Index | *KOSPI | 2594.36 | -16.02 | -0.61 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 10388.52 | 31.25 | 0.3 |

Overnight in the U.S., stocks rose as oil prices eased.

The S&P 500 gained 0.97%, and the Nasdaq Composite rose 1.45%. The Dow Jones Industrial Average added 0.3%.

West Texas Intermediate oil futures dropped 4.6% Tuesday as traders monitored Israel’s expected retaliation to Iran missile attacks and U.S. efforts to prevent a wider regional conflict.

— CNBC’s Samantha Subin and Alex Harring contributed to this report.

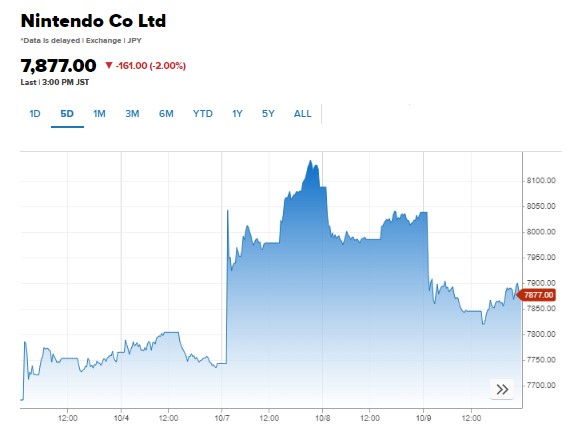

Nintendo shares slip over 2% after PIF cuts stake

Shares of Japanese video-game company Nintendo fell as much as 2.32%, a day after Saudi Arabia’s Public Investment fund trimmed its stake in the company.

Japanese regulatory filings confirmed that the PIF cut its stake in the company to 7.54% from 8.58%.

This comes after Kyodo News reported on Monday that a senior executive at the country’s mammoth sovereign wealth fund said it was considering raising stake in Nintendo, sending shares higher.

— Lim Hui Jie

New Zealand central bank slashes interest rates by 50 basis points in second straight cut

The Reserve Bank of New Zealand cut its benchmark interest rate by 50 basis points following a monetary policy meeting on Wednesday.

The move is the bank’s second straight cut after it unexpectedly cut rates by 25 basis points in August and brings the Reserve Bank of New Zealand’s interest rate to 4.75%.

The latest adjustment was in line with expectations of economists polled by Reuters.

— Dylan Butts

Seven & i jumps over 4% as Couche-Tard reportedly raises buyout offer by 20%

Shares of Seven & i rose more than 4% after Canadian convenience store operator Alimentation Couche-Tard reportedly raised its offer for the parent company of 7-Eleven by about 20%.

Couche-Tard had proposed Seven & i a new potential acquisition price of $18.19 per share last month, Bloomberg reported, citing people with knowledge of the matter.

The revised offer was aimed at initiating discussions and sent to Seven & i on Sept. 19, the report added.

— Lim Hui Jie

Japanese manufacturers’ sentiment improves in October: Reuters Tankan

Sentiment at large Japanese manufacturers improved in October, according to a monthly Reuters poll.

The Reuters Tankan survey, which tracks the quarterly business survey from the Bank of Japan, showed that the sentiment index climbed to +7 from +4.

However, sentiment among non-manufacturing firms slipped to +20 in October, down from +23.

— Lim Hui Jie

Boston Fed’s Collins sees more rate cuts ahead

Boston Federal Reserve President Susan Collins said Tuesday she expects more interest rate cuts ahead as inflation eases and the labor market cools.

“My confidence in the disinflation trajectory has increased – but so have the risks of the economy slowing beyond what is needed to restore price stability,” Collins said in a speech to bankers in Boston. “Further adjustments of policy will likely be needed.”

The central bank official noted that the Fed’s “dot plot” after its September meeting pointed to an additional 50 basis points, or half percentage point, in reductions before the end of the year, though she did not specify whether she agrees with the consensus.

—Jeff Cox

Trade deficit fell more than expected in August

The U.S. trade deficit fell more than 10% in August as exports surged, imports declined and the shortfall with China shrunk.

The goods and services imbalance totaled $70.4 billion for the month, down 10.8% from the upwardly revised $78.9 deficit in July, the Commerce Department reported Tuesday. Economists surveyed by Dow Jones were looking for $70.8 billion.

That came as exports rose $5.3 billion, or 2%, and imports declined by $3.2 billion, or 0.9%. However, the year to date trade deficit is still 8.9% higher than the same period a year ago.

—Jeff Cox

Oil is selling off after surging on Middle East war fears

Crude oil futures were down nearly 3% in morning trading as fears of imminent retaliation by Israel against Iran have eased somewhat.

U.S. crude oil was down $2.25, or 2.92%, to $74.89 per barrel at around 9:17 a.m. ET. Global benchmark Brent had fallen $2.26, or 2.79%, to $78.67 per barrel.

Oil prices surged 13% through Monday’s close since Iran launched about 180 ballistic missiles at Israel last week. Iran’s attack had raised fears that Israel might retaliate by hitting the country’s oil industry. President Joe Biden, however, has publicly discouraged Israel from taking this course.

The market was also disappointed that Chinese officials did not announce new stimulus at a press briefing Tuesday. Prior to the escalation in the Middle East, the oil market was swept by bearish sentiment on soft demand in China and worries that crude supplies will outpace global demand next year.

— Spencer Kimball