- May 6, 2024

- By: Admin1_blog

- Asia Market, Indices, Singe Stock CFD, SoegeeFX News

Lim Hui Jie

Asia-Pacific markets tracked Wall Street gains on Monday as a softer-than-expected U.S. jobs report fueled hopes that the Federal Reserve could start cutting rates soon.

Investors, meanwhile, awaited the Reserve Bank of Australia’s rate decision on Tuesday and China’s April trade data on Thursday.

ING said in a note last week that the RBA meeting was “worth watching closely,” adding that recent inflation data from Australia showed growth in prices was starting to accelerate.

However, the analysts said Australia’s inflation data was better than they had expected, and compared to the US, the country’s economy had slowed more with the labor market softening substantially. As such, they forecast no change to the RBA’s rate of 4.35%.

On Monday, composite purchasing managers’ index readings will be released by S&P Global for Hong Kong, while service PMI readings will be out for mainland China and India.

Japan and South Korea’s markets are closed for a public holiday.

Australia’s S&P/ASX 200 rose 0.7% to close at 7,682.4, marking a third straight day of gains.

Hong Kong’s Hang Seng index was flat, while mainland China’s CSI 300 rose 1.30% as traders returned from Labor Day holiday.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38236.07 | -37.98 | -0.1 |

| .HSI | Hang Seng Index | *HSI | 18561.29 | 85.37 | 0.46 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7682.4 | 53.4 | 0.7 |

| .SSEC | Shanghai | *SHANGHAI | 3139.54 | 34.72 | 1.12 |

| .KS11 | KOSPI Index | *KOSPI | 2676.63 | -7.02 | -0.26 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9541.65 | 38.13 | 0.4 |

On Friday in the U.S., stocks jumped sharply after a softer-than-expected April jobs report.

Friday’s nonfarm payrolls report showed 175,000 jobs were added in April, below the 240,000 jobs expected by economists surveyed by Dow Jones.

The unemployment rate edged up to 3.9%, versus 3.8% in the prior month, according to the Bureau of Labor Statistics. Wage figures also came in less than expected, an encouraging sign for inflation.

The S&P 500 surged 1.26% to notch its best day since February, while the Nasdaq Composite rallied 1.99%. The Dow Jones Industrial Average gained 1.18%.

— CNBC’s Samantha Subin and Pia Singh contributed to this report.

Indonesia’s first-quarter GDP grows at fastest pace in three quarters

Indonesia’s first-quarter gross domestic product climbed 5.11% year on year, marking its fastest expansion in three quarters.

The reading also beat the 5% growth expected by economists polled by Reuters.

On a quarter-on-quarter basis, Southeast Asia’s largest economy posted a 0.83% decline, softer than the 0.89% expected by the Reuters poll.

— Lim Hui Jie

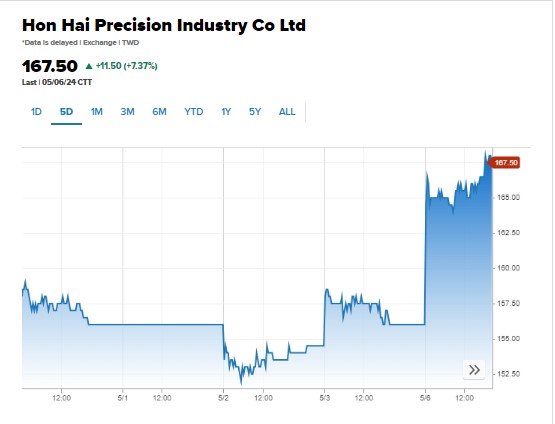

Foxconn shares spike almost 7% after April sales soar almost 20%

Shares of iPhone manufacturer Foxconn spiked as much as 6.73% after the company reported a 19.03% year-on-year rise in April revenue.

Foxconn, which trades as Hon Hai Precision Industry in Taiwan, recorded 510.9 billion New Taiwan dollars ($15.83 billion) in revenue in April, compared to the NT$447.54 billion recorded in March.

The company said that its component business, as well as its cloud and networking products “delivered strong growth,” while its smart consumer electronics and computing products segment “showed significant year on year growth in revenue.”

— Lim Hui Jie

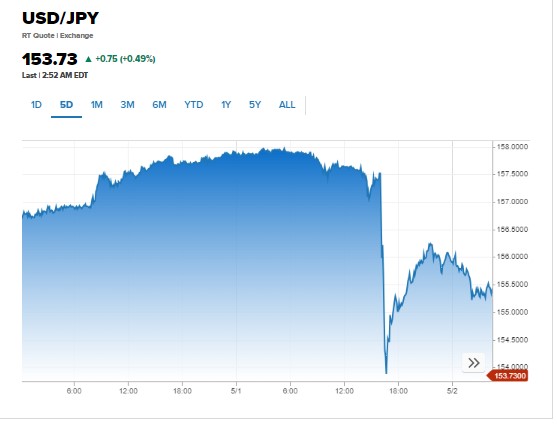

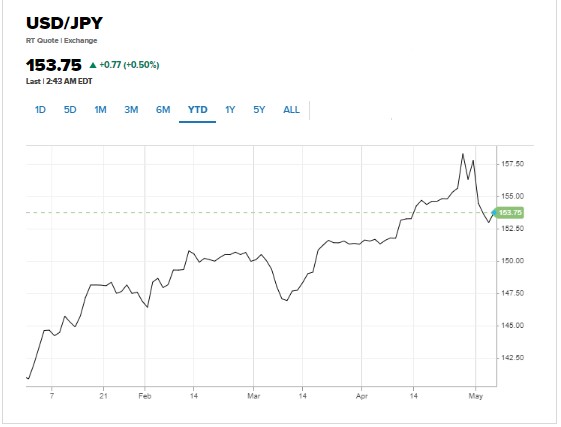

Yen to face resistance at 150 against the dollar: SMBC

The Japanese yen will face upside resistance against the U.S. dollar at the 150 level despite two rounds of suspected intervention by Japanese authorities last week, says SMBC economist Ryota Abe.

The yen abruptly strengthened on April 29 and May 2, leading analysts to believe that Japan’s finance ministry bought yen to stem the currency’s slide.

Abe also noted that Japan’s authorities are unlikely to intervene unless the yen weakens again. But he also said that the rate differential between the U.S. and Japan will remain as such if both central banks keep their monetary policies unchanged.

The yen was trading at 153.64 at 11:18 a.m. Tokyo time.

— Lim Hui Jie

Caixin China services PMI comes in at 52.5 in April

A private survey showed the expansion in China’s services activity slowed slightly in April from March.

The Caixin/S&P Global services purchasing managers’ index came in at 52.5 in April, ticking down from 52.7 in March.

“Although slightly softer, growth was again solid and has now been sustained for 16 consecutive months,” the survey read.

A PMI reading above 50 indicates an expansion in activity, while a reading below that level points to a contraction.

— Shreyashi Sanyal

Hong Kong’s private sector expands at slower pace in April

Business activity in Hong Kong’s private sector expanded at a slower pace in April, according to S&P Global.

The purchasing managers’ index for the city slipped to 50.6 from March’s 50.9.

Jingyi Pan, Economics Associate Director at S&P Global Market Intelligence, said the reading signaled another improvement in business conditions at the start of the second quarter.

However, Pan said the growth appears to be on “shaky ground,” highlighting that forward-looking indicators, such as the decline in new business orders in April, hinted at softening conditions.

— Lim Hui Jie

CNBC Pro: Samsung or SK Hynix? One’s a better play on the AI boom, according to most of the pros

Big Tech names like Nvidia have been on fire, thanks to the artificial intelligence boom — and other chipmakers are sharing the limelight.

The supply chain for AI is extensive. It includes companies in Asia-Pacific and ranges from producers of AI graphics processing units to printed circuit boards.

Memory chips in particular have been in the spotlight as AI ramps up.

Two stocks have dominated the memory chip market: Samsung and SK Hynix.

Which is the better play on the AI boom? CNBC Pro spoke to the pros to find out.

— Weizhen Tan

CNBC Pro: Goldman Sachs refreshed its conviction lists of global stocks — giving one 67% upside

Called the “Conviction List – Directors’ Cut,” the lists capture names across Europe and Asia-Pacific.

The investment banks’ “Conviction List – Directors’ Cut” seeks to offer investors a “curated and active” list of 15 to 25 buy-rated stocks.

— Amala Balakrishner

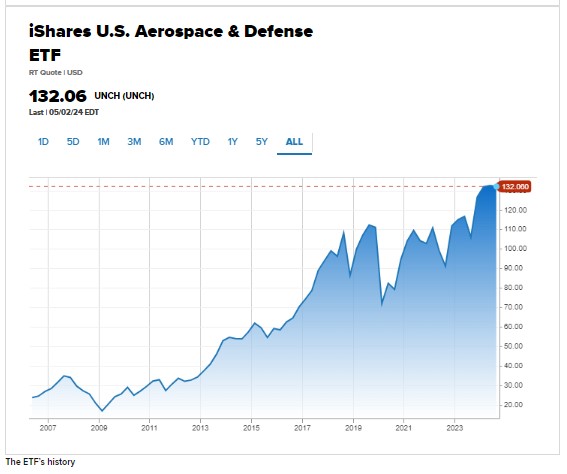

Defense ETF reaches new record high

The iShares U.S. Aerospace & Defense ETF (ITA) hit a record high on Friday.

The exchange-traded fund at one point traded above $133 in Friday’s session, notching the highest intraday price going back to its inception in 2006. Several members including Heico, Howmet Aerospace and TransDigm also touched their most expensive prices in at least a year.

The fund has gained more than 4% compared with the start of 2024.

— Alex Harring, Gina Francolla

U.S. economy added fewer jobs than expected in April

The nonfarm payrolls report for April showed 175,000 jobs added, below the 240,000 jobs expected by economists surveyed by Dow Jones.

The unemployment rate ticked up to 3.9%, compared to 3.8% in the prior month, according to the Bureau of Labor Statistics.

Revisions to February and March jobs numbers decreased the cumulative jobs added in those periods by 22,000.

— Jesse Pound

Japanese yen recovers 4.5% against U.S. dollar, set for best week in more than a year

The Japanese yen was trading at 152.93 against the U.S. dollar and was set to end its best week in more than a year, despite hitting its weakest level since 1990 on Monday at 160.03.

Analysts, including from Bank of America, have suggested there were likely two interventions carried out by Japanese authorities during the week, on Monday and Wednesday. The authorities are yet to make an official statement to confirm the interventions.

“The government has been refusing to disclose whether they’ve been intervening or not, but I don’t think many people have any doubts,” Nicholas Smith, Japan strategist at CLSA, told CNBC.

The yen has recovered some 4.5% since it hit a 34-year low on Monday.

— Shreyashi Sanyal

Source : cnbc