- May 22, 2024

- By: Admin1_blog

- Asia Market, Indices

Lee Ying Shan

Asia-Pacific markets traded mixed Wednesday following a slew of economic data out of Japan.

Japan’s Nikkei 225 fell marginally lower by 0.62%, following a slight improvement in business sentiment, with the Reuters Tankan non-manufacturing index coming in at +26. Japan is slated to release its April trade data, as well as machinery orders for the month of March.

South Korea’s benchmark index Kospi inched up 0.23%, while Hong Kong’s Hang Seng index rose 0.18%. The CSI 300 was up 0.067%.

In Australia, the S&P/ASX 200 closed flat at 7,851.9.

New Zealand’s S&P/NZ50 inched up 0.14% to close at 11,692.6 after the Reserve Bank of New Zealand held official cash rate unchanged at 5.5% for the seventh consecutive time.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38619.68 | -327.25 | -0.84 |

| .HSI | Hang Seng Index | *HSI | 19265.51 | 44.89 | 0.23 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7851.6 | -0.1 | 0 |

| .SSEC | Shanghai | *SHANGHAI | 3157.08 | -0.88 | -0.03 |

| .KS11 | KOSPI Index | *KOSPI | 2725.58 | 1.4 | 0.05 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9786.14 | 18.19 | 0.19 |

Overnight in the U.S., all three indexes closed in positive territory, with the S&P 500 and the Nasdaq Composite closing at new records as investors looked toward AI darling Nvidia’s earnings report.

The Nasdaq Composite rose 0.22% to 16,832.62. The S&P 500 added 0.25% to 5,321.41. The Dow Jones Industrial Average closed 0.17% higher at 39,872.99.

— CNBC’s Hakyung Kim and Alex Harring contributed to this report

Hong Kong-listed shares of Xpeng up 13% after predicting growth in car deliveries

Shares of Xpeng soared more than 13% in Hong Kong trade on Wednesday, after the Chinese EV maker reported an improvement in profit margin and an upbeat outlook for second-quarter deliveries.

U.S.-listed shares had climbed by nearly 6% in U.S. trade Tuesday after reporting first quarter results.

Xpeng reported that vehicle margin — a measure of profitability — rose 5.5% in the first three months of the year, from a negative 2.5% in the prior quarter.

— Evelyn Cheng

New Zealand central bank keeps rate on hold

The Reserve Bank of New Zealand held official cash rate unchanged at 5.5% for the seventh consecutive time.

New Zealand’s inflation fell from 4.7% in the last quarter of 2023 to 4% in the first quarter this year, data from LSEG showed. The RBNZ Committee maintained that inflation numbers are still above its 1% to 3% target.

“The Committee agreed that monetary policy needs to remain restrictive to ensure inflation returns to target within a reasonable timeframe,” the bank said.

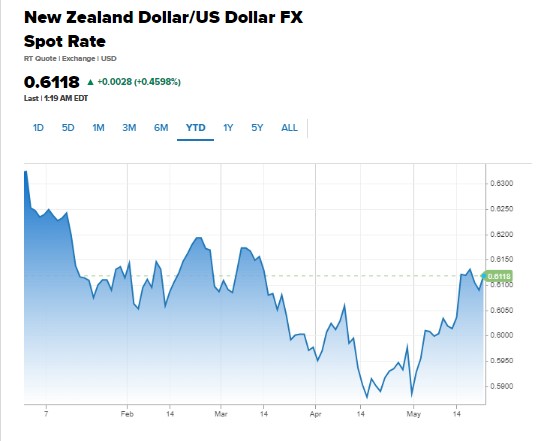

The kiwi last traded 0.614 against the dollar.

Katrina Ell, director of economic research at Moody’s Analytics, told CNBC’s “Street Signs Asia” that a rate cut is “not a now situation.”

“The earliest possibility of a rate cut actually coming to be in New Zealand will be … late this year. It’s not a next couple of months,” she said, adding that inflation is “moving in the right direction.”

— Lee Ying Shan

Japan’s machinery orders for March rise

Japan’s machinery orders rose 2.7% year-on-year, compared to Reuters’ expectations of a 2.3% climb.

On a month-on-month basis, core machinery orders rose 2.9% versus estimates of a 2.2% fall, LSEG data showed.

Core machinery orders tend to be volatile, but serve as a key gauge for capital expenditure.

According to Japan’s Cabinet Office, core orders are forecast to fall by 1.6% quarter on quarter in the April to June period, after climbing 4.4% in the January-March period.

— Lee Ying Shan

Japanese exports in April rise, trade deficit larger than expected

Japan’s exports for April climbed 8.3% year-on-year, according to numbers released by the Ministry of Finance.

It was higher than the 7.3% rise in March, but below expectations of a 11.1% rise by economists polled by Reuters. Exports to China grew 9.6%, the data showed.

Imports in April were also higher, climbing 8.3% compared to a year ago.

Japan’s trade balance came up to a deficit of 462.5 billion yen ($2.96 billion), a larger deficit than Reuters’ forecast of 339.5 billion yen.

— Lee Ying Shan

Japan business sentiment in May sees marginal improvement

Business sentiment at large Japanese firms improved marginally in May, according to the monthly Reuters Tankan survey.

The sentiment index for manufacturers came in at +9, the same as April.

The poll also showed the non-manufacturing index at +26, up slightly from +25 in April. A positive figure indicates that optimists outnumber pessimists in the sector, and vice versa.

The Reuters monthly poll is considered to be a leading indicator of the Bank of Japan’s official survey.

— Lee Ying Shan

CNBC Pro: These 6 other chip stocks tend to move on Nvidia earnings

Six artificial intelligence-related stocks worldwide have consistently reacted positively to Nvidia’s quarterly results, according to CNBC Pro research.

The analysis comes ahead of Nvidia’s first-quarter earnings this year, which will be released Wednesday after the stock markets close.

Five six stocks have each risen between 6% and 33% in the past after Nvidia revealed bumper earnings.

— Ganesh Rao

Stocks end Tuesday’s session higher

U.S. stocks ended Tuesday’s trading session in the green. The S&P 500 added 0.25% and the Nasdaq Composite rose 0.22%. Both indexes closed at new record highs. Meanwhile, the Dow Jones Industrial Average gained 0.17%.

— Hakyung Kim

CNBC Pro: Morgan Stanley’s Slimmon names tech stocks to buy at a ‘reasonable price’

Morgan Stanley Investment Management’s Andrew Slimmon has been consistently bullish on stocks — even during periods of volatility.

While he fears that a change in market conditions could cause “some sort of equity correction,” the senior portfolio manager believes it’s “clear sailing” for stocks for now.

“I think it will make sense to get a little more defensive going into the summer but it’s too early for that,” he said. “Stick with a balance of growth and value names.”

He names four stocks to buy.

— Weizhen Tan

Coffee futures pop nearly 5%, head for third consecutive positive day

Coffee futures jumped 4.7% Tuesday and headed for a third consecutive winning day.

Prices also hovered near their highest level since May 2, hitting a high of $216.10 per pound. Coffee futures have risen more than 16% since the start of the year.

— Samantha Subin, Gina Francolla

Source : cnbc