- December 5, 2024

- By: Admin1_blog

- Asia Market, Indices

Anniek Bao

Asia-Pacific markets traded mixed Thursday after Wall Street stock benchmarks notched record highs, shrugging off global political turmoil.

Investors are continuing to monitor the political situation in South Korea and France. Less than a day after he declared martial law, lawmakers in South Korea filed a motion to impeach President Yoon Suk Yeol.

The leader of Yoon’s ruling People Power Party, Han Dong-hoon, said on Thursday that the party will try to oppose the motion, Yonhap News Agency reported. In emails sent to NBC News, Yoon’s office has maintained that his call for martial law was constitutional.

The opposition party’s deputy spokesperson Cho Seung-rae reportedly said it planned to hold the vote on Saturday 7 p.m. local time, according to local media.

South Korea released its third-quarter revised gross domestic product, which showed the economy expanded 0.1% quarter-on-quarter, and 1.5% on an annual basis, unchanged from advanced estimates.

South Korea’s market opened higher but quickly lost momentum. The Kospi fell by 0.44% while the Kosdaq was down 0.14%.

Elsewhere in Asia, Australia’s S&P/ASX 200 added 0.1% to finish at 8,471.10.

Japan’s Nikkei 225 jumped 0.31%, while the Topix traded near the flatline.

Hong Kong’s Hang Seng index futures dropped just over 1%, while mainland China’s CSI 300 index shed 0.13%.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 39432.38 | 155.99 | 0.4 |

| .HSI | Hang Seng Index | *HSI | 19548.53 | -193.93 | -0.98 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 8474.9 | 12.3 | 0.15 |

| .SSEC | Shanghai | *SHANGHAI | 3370.55 | 5.9 | 0.18 |

| .KS11 | KOSPI Index | *KOSPI | 2451.77 | -12.23 | -0.5 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 10157.74 | 11.65 | 0.11 |

“Investors may now attach a higher political risk premium to South Korea in the long term,” Alex Smith, head of equities investment specialist at abrdn, said in a note on Thursday, adding that the Bank of Korea and finance ministry have “helped calm the markets” by promising liquidity support.

While noting that the immediate impact on financial markets may be short-lived, the political uncertainty will add to investors’ concerns over the economy’s exposure to potential “punitive trade actions” from the incoming U.S. administration, Smith said.

Meanwhile, French lawmakers on Wednesday passed a no-confidence vote against the government of Prime Minister Michel Barnier.

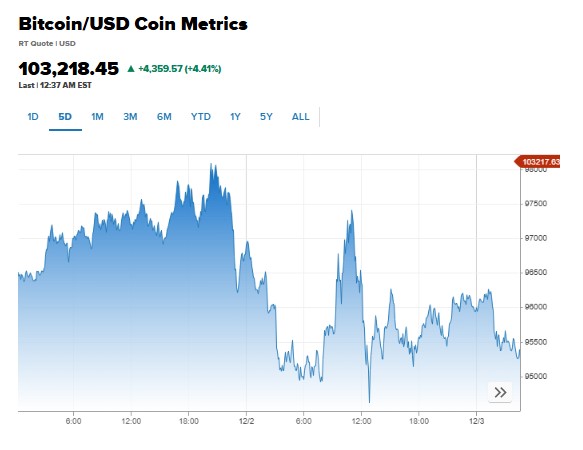

Amid the political turmoil in Asia and Europe, bitcoin surged and crossed the $100,000 mark, hitting a record of $103,844, according to Coin Metrics.

In the U.S. on Wednesday, all three major indexes hit all-time highs during the session and closed at records, with tech shares leading the gains.

The Dow Jones Industrial Average advanced 308.51 points, or 0.69%, to 45,014.04, crossing the 45,000 threshold for the first time.

The S&P 500 broad market index gained 0.61% to close at 6086.49, while the tech-heavy Nasdaq Composite advanced 1.3% to close at 19,735.12.

The rally came as investors digested Fed Chair Jerome Powell’s comments Wednesday that the recent strength of the U.S. economy means U.S. central bank can afford to be “a little more cautious.”

Investors are awaiting the U.S. November unemployment report, due Friday, which would provide some insights into the Fed’s future policy moves. The next rate decision comes in two weeks, and markets are pricing in a roughly 78% chance of a quarter percentage point rate cut by the Federal Open Market Committee, according to the CME Group’s FedWatch tool.

— CNBC’s Sean Conlon, Lisa Kailai Han and Hakyung Kim contributed to this report.

Bank of Japan board member thinks Japan may miss 2% inflation target in the coming years

Bank of Japan board member Toyoaki Nakamura said that the country could miss the BOJ’s inflation target of 2% in its fiscal year 2026.

Nakamura said that he was “still not confident about the sustainability of wage increases,” according to a Google translation of his statement in Japanese. Japan’s economy might grow slower than the BOJ’s forecast, he said.

In its October outlook, the BOJ had forecast that Japan’s economy would grow at an average 1% fiscal year 2026, while headline inflation rate was pegged at 1.8% to 2%.

Nakamura is among the most dovish members of the board, having voted against raising rates in the July monetary policy meeting and also against the plan to reduce purchases of Japanese government bonds at the June meeting.

— Lim Hui Jie

Bitcoin tops $100,000 for the first time ever

The price of bitcoin soared past the long-awaited $100,000 benchmark for the first time ever late Wednesday evening.

The flagship cryptocurrency was last higher by more than 7% at $102,879.60, according to Coin Metrics. Earlier, it rose as high as $103,844.05.

The move came hours after President-elect Donald Trump announced plans to nominate Paul Atkins as chair of the Securities and Exchange Commission. The same day, Federal Reserve Chair Jerome Powell said bitcoin was “just like gold only it’s virtual, it’s digital,” speaking at the DealBook conference.

— Tanaya Macheel

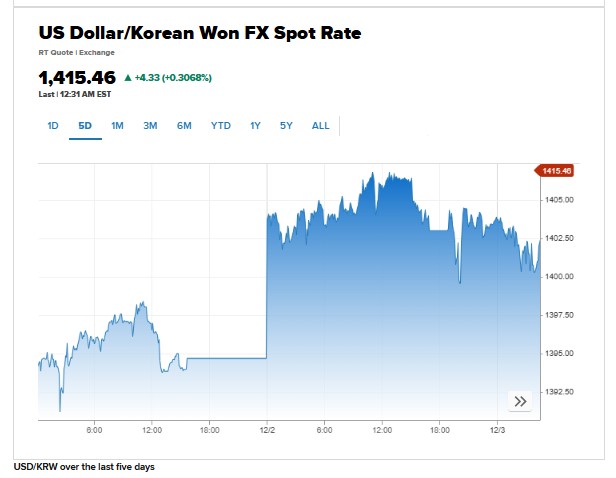

Korean won inches higher against the dollar

The South Korean won strengthened slightly 0.2% against the dollar on Wednesday. The dollar was last trading at 1,412.80 won.

The move higher comes a day after South Korea President Yoon Suk Yeol issued a martial law decree in a move that shocked the country and rattled financial markets. The won fell as low as the 1,442 won level Tuesday before the National Assembly had voted to lift the martial law declaration.

— Hakyung Kim

Stock futures open little changed

U.S. stock futures hovered just below the flatline Wednesday night.

Futures tied to the Dow Jones Industrial Average lost 16 points, or 0.04%. Additionally, S&P 500 futures inched lower by 0.07%, while Nasdaq 100 futures fell 0.1%.

— Sean Conlon

S&P 500, Nasdaq notch new closing highs

The S&P 500 and Nasdaq Composite ended Wednesday’s session by cinching new closing highs.

The broad market index added 0.61%, finishing at 6,086.49. The tech-heavy Nasdaq rose 1.3% to 19,735.12. The Dow Jones Industrial Average added 308.51 points, or 0.69%, and closed at 45,014.04 — marking the first time the 30-stock index ended the day above 45,000.

— Lisa Kailai Han

Stocks making the biggest moves after hours

Check out the stocks making headlines in extended trading:

Five Below – The discount retailer advanced about 11% after posting third-quarter revenue of $844 million, well above the $799 million analysts polled by LSEG had expected. Adjusted earnings also topped the Street’s expectations. The company also guided for a fourth-quarter revenue range that encompassed the average consensus estimate.

Synopsys – The stock fell more than 6% after the company’s fiscal first-quarter forecast came in lower than analysts were expecting. Synopsys expects earnings to come in between $2.77 and $2.82 per share, well below the $3.53 per share that analysts had penciled in, per LSEG. The company also guided for first-quarter revenues that were lower than consensus, forecasting between $1.435 billion and $1.465 billion in the quarter. Analysts surveyed by LSEG were looking for $1.631 billion.

— Sean Conlon

CNBC Pro: ‘It is key to remain invested,’ Julius Baer portfolio manager says. Here’s how she’s investing

The persistent uncertainty in financial markets has raised questions on portfolio construction and how to invest across asset classes as 2025 nears.

One long-term investor is now playing the market by staying invested and being well-diversified.

“We believe it is key to remain invested and view any potential corrections as technical and temporary opportunities to get into the market,” Julius Baer International’s portfolio manager Aneka Beneby said.

She also revealed how and what she is allocating to in the lead up to the new year.

— Amala Balakrishner

Source : cnbc