- March 5, 2025

- By: Admin1_blog

- Asia Market, Indices

Lee Ying Shan

Asia-Pacific markets were mostly higher Wednesday as investors assessed China growth and inflation targets amid U.S. tariffs and escalating global trade tensions weighing down sentiment.

Australia’s S&P/ASX 200 fell 0.70% to close at 8,141.1. Australia’s economy expanded 1.3% year on year in the fourth quarter, beating expectations of 1.2% from economists polled by Reuters.

Japan’s Nikkei 225 added 0.23% to close at 37,418.24 while the Topix climbed 0.30% to end the trading day at 2,718.21. South Korea’s Kospi rose 1.16% to close at 2,558.13 while the small-cap Kosdaq advanced 1.23% to 746.95.

Hong Kong’s Hang Seng Index added 2.8%, while mainland China’s CSI 300 rose 0.45% to close at 3,902.57.

Investors are also focused on China’s “Two Sessions,” an annual parliamentary gathering, with the meeting of its top legislature, the National People’s Congress, kickstarting Wednesday.

China on Wednesday set its GDP growth target for 2025 at around 5%. The country has also lowered its inflation expectations to “around 2%.”

Trump’s 25% tariffs on goods from Mexico and Canada took effect Tuesday. The president also imposed an additional 10% duty on Chinese goods, bringing the total new tariffs on China to 20%.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 37418.24 | 87.06 | 0.23 |

| .HSI | Hang Seng Index | *HSI | 23594.21 | 652.44 | 2.84 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 8141.1 | -57 | -0.7 |

| .SSEC | Shanghai | *SHANGHAI | 3341.96 | 17.75 | 0.53 |

| .KS11 | KOSPI Index | *KOSPI | 2558.13 | 29.21 | 1.16 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 10408.54 | 119.39 | 1.16 |

Overnight in the U.S., the three major averages closed lower. The Dow Jones Industrial Average tumbled for a second day, dropping 670.25 points, or 1.55% and ended the session at 42,520.99. The S&P 500 dropped 1.22% to close at 5,778.15 after notching its worst day of the year in the prior session. The Nasdaq Composite lost 0.35% and finished at 18,285.16.

—CNBC’s Lisa Kailai Han and Alex Harring contributed to this report.

Reserve Bank of New Zealand’s governor resigns

New Zealand central bank’s Governor Adrian Orr has resigned after seven years and will complete service on March 31, according to an official statement.

Deputy Governor Christian Hawkesby will be acting governor until the end of March, as well as chair the Monetary Policy Committee. New Zealand’s minister of finance will appoint a temporary governor from April 1 for a period of up to six months.

—Lee Ying Shan

China targets ‘around 5%’ growth in 2025 as trade worries mount

China on Wednesday set its GDP growth target for 2025 at “around 5%” as it starts its annual parliamentary meeting amid escalating trade tensions with the U.S.

Beijing raised its budget deficit target to expected 4% of GDP, from 3% last year.

The 4% deficit would mark the highest on record going back to 2010, according to data accessed via Wind Information. The prior high was 3.6% in 2020, the data showed.

— Evelyn Cheng

Bitcoin erases all of its gain from Trump crypto reserve announcement

The price of bitcoin failed to recover the $85,000 level — where it traded before President Donald Trump’s announcement of a U.S. crypto reserve sent it soaring — after a sell-off driven by tariff concerns knocked it down.

Bitcoin was last lower by 2% on Tuesday at $83,508.78, according to Coin Metrics, and off its all-time high by 23%.

Coinbase and Robinhood fell 2% and 4%, respectively, in premarket trading. Strategy, formerly known as MicroStrategy, lost 4%.

Investors and analysts warn that economic uncertainty could keep its hold on bitcoin throughout March, with the crypto industry absent a specific catalyst. After reaching its record in January, it posted its worst month since 2022 in February.

— Tanaya Macheel

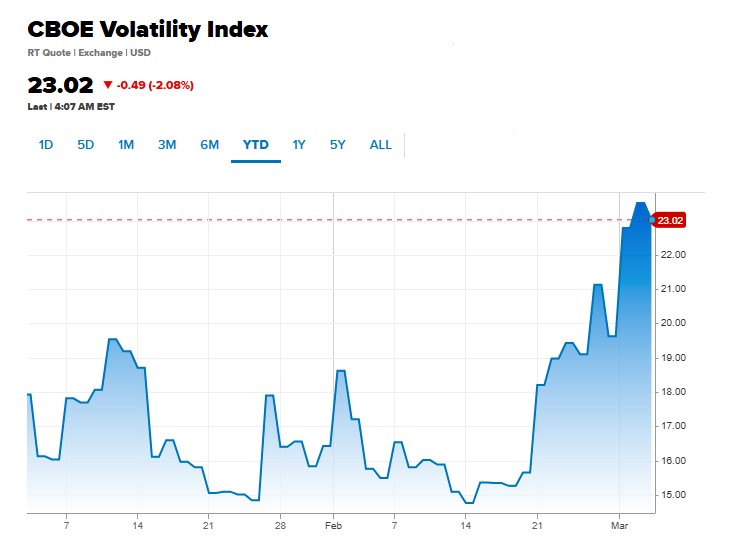

Wall Street’s fear gauge rises as tariffs on Canada and Mexico begin

Wall Street’s so-called fear gauge, the CBOE Volatility Index (VIX), shot up as President Donald Trump’s tariffs took effect.

The index rose more than 1 point on Tuesday, the first day with Trump’s 25% levies on Mexico and Canada in action. The VIX saw its biggest one-day spike of 2025 on Monday, jumping more than 3 points after Trump reaffirmed plans for the long-awaited import taxes to go forward, which hampered hopes of a last-minute deal.

The VIX in 2025

— Alex Harring

Source : cnbc.com