- August 21, 2024

- By: Admin1_blog

- Asia Market, Indices

Lim Hui Jie

Key Points

- Japan’s July exports rose 10.3% year on year and imports rose 16.6% in the same period, compared to expectations of a 11.4% rise for exports and a 14.9% growth for imports.

- It was the last month of trade data recorded before the Bank of Japan’s move to raise interest rates at the end of July, which caused the yen to strengthen dramatically.

Asia-Pacific markets mostly fell on Wednesday after U.S. benchmark indexes, the S&P500 and the Nasdaq Composite, snapped an eight-day winning streak overnight.

Japan’s trade data for July showed exports rose 10.3% year on year and imports grew 16.6%. Economists polled by Reuters had forecast that exports would rise 11.4%, while imports growth was pegged at 14.9%.

With exports coming in lower than expected and imports rising more than expected, Japan swung to a trade deficit of 621.84 billion yen ($4.28 billion), a larger figure than the 330.7 billion yen expected by economists.

July will be the last month of trade data recorded before the Bank of Japan’s move to raise interest rates at the end of July, which caused the yen to strengthen dramatically.

Typically, a weaker yen benefits Japanese exporters and trading houses, heavyweights on the Nikkei 225 and whose rise has been instrumental in lifting the index to its record highs.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 37956.59 | -106.33 | -0.28 |

| .HSI | Hang Seng Index | *HSI | 17325.38 | -185.7 | -1.06 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7993.9 | -3.8 | -0.05 |

| .SSEC | Shanghai | *SHANGHAI | 2854.78 | -11.89 | -0.41 |

| .KS11 | KOSPI Index | *KOSPI | 2702.51 | 5.88 | 0.22 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9988.11 | -45.76 | -0.46 |

Japan’s Nikkei 225 slipped 0.24% after the data release, while the broad based Topix fell 0.23%.

Hong Kong’s Hang Seng index tumbled 0.93%, while mainland China’s CSI 300 was 0.19% lower.

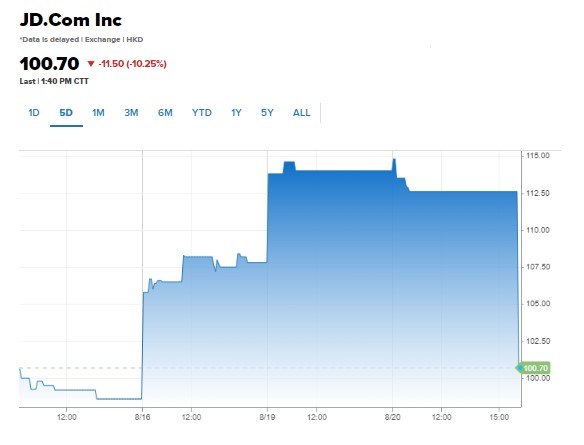

Technology and consumer cyclical stocks dragged the HSI, with e-commerce giant JD.com leading declines, down 11.4%. The losses come after U.S. retail giant Walmart told CNBC it was looking to sell its stake in JD.com. The stake could reportedly be worth $3.74 billion.

South Korea’s Kospi reversed losses to climb 0.26%, becoming the only major index in positive territory, but the small-cap Kosdaq was down 0.91%.

Australia’s S&P/ASX 200 also fell marginally.

Overnight, the S&P 500 slid 0.2%, while the Nasdaq Composite shed 0.33%. The Dow Jones Industrial Average dropped 0.15%. If the S&P had gained on Tuesday, it would have been the broad index’s longest winning streak since 2004.

Source : cnbc