- May 17, 2024

- By: Admin1_blog

- Asia Market, Indices

Shreyashi Sanyal & Lim Hui Jie

Asia-Pacific markets mostly fell Friday, as investors assessed key China data to gauge the state of the world’s second-largest economy.

Data from China showed retail sales rose by 2.3% in April from a year earlier. The reading was less than the 3.8% increase forecast by a Reuters poll, and slower than the 3.1% pace reported in March.

Mainland China’s CSI 300 index fell 0.20% after the data.

Investors also assessed data from Singapore, which showed non-oil domestic exports in April declined by 9.3%, slower than the preceding month.

Japan’s Nikkei 225 slid 0.36%, while the broad-based Topix reversed early declines to add 0.26%.

South Korea’s Kospi was down 0.93% after the country’s unemployment rate remained unchanged at 2.8% in April, while the small-cap Kosdaq dropped 1.58%.

In Australia, the S&P/ASX 200 fell 0.71%.

Hong Kong’s Hang Seng index gained 0.29%.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38787.38 | -132.88 | -0.34 |

| .HSI | Hang Seng Index | *HSI | 19474.16 | 97.63 | 0.5 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7814.4 | -66.9 | -0.85 |

| .SSEC | Shanghai | *SHANGHAI | 3126.21 | 3.81 | 0.12 |

| .KS11 | KOSPI Index | *KOSPI | 2726.39 | -26.61 | -0.97 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9786.61 | -9.39 | -0.1 |

Overnight in the U.S., the Dow Jones Industrial Average closed slightly lower, after briefly jumping above 40,000 for the first time.

The blue-chip index hit a high of 40,051.05. It had neared the 40,000 mark earlier this year before a slight April pullback on worries over high interest rates.

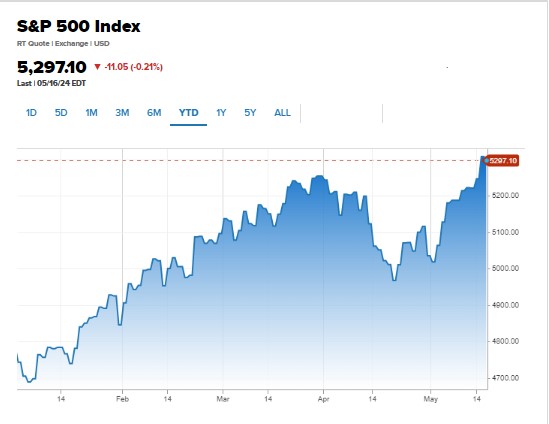

During the session, the S&P 500 also climbed to a new record after closing above the 5,300 level for the first time ever on Wednesday. The tech-heavy Nasdaq also hit an all-time high.

The 30-stock Dow ended the day down 0.1% at 39,869.38. The S&P 500 fell 0.21%, while the Nasdaq Composite finished the day 0.26% lower.

— CNBC’s Tanaya Macheel and Lisa Kailai Han contributed to this report.

IMF warns that Biden’s China tariffs threaten world growth

The International Monetary Fund has criticized the Biden administration’s sweeping tariff hikes on a range of imports, warning that escalating U.S.-China tensions could harm global trade and growth.

“Fragmentation of this type can be very costly for the global economy,” IMF spokeswoman Julie Kozack said when asked about the policy at a press briefing on Thursday, adding “the U.S. would be better served by maintaining open trade policies that have been vital to its economic performance.”

Kozack pointed to previous IMF analysis that found that fragmentation between U.S.-led Western and China-aligned economic blocs threatens global trade cooperation and losses of global GDP up to 7%.

The U.S. and China should work together to address underlying concerns that have exacerbated trade tensions between the two countries, she added.

— Dylan Butts

Malaysia’s first-quarter GDP growth tops estimates at 4.2%

Malaysia’s economy grew 4.2% year on year in the first quarter of 2024, according to official data, beating Reuters poll estimate of 3.9%.

The reading was the highest since the first quarter of 2023, when its economy GDP came in at 5.5%.

Malaysia’s GDP had expanded 2.9% in the previous quarter.

The report said the supply side was helped by services and manufacturing sectors, while private final consumption expenditure and gross fixed capital formation were the main drivers on the demand side.

— Shreyashi Sanyal

Country Garden’s liquidation hearing in Hong Kong court adjourned

A hearing for a petition seeking the liquidation of debt-laden Chinese property firm Country Garden Holdings was adjourned by a Hong Kong court to June 11, according to Reuters.

The troubled real estate company received a liquidation petition filed by one of its creditors in late February.

It had received a “winding-up” petition dated Feb. 27 filed by Ever Credit Limited for the non-payment of a loan worth 1.6 billion Hong Kong dollars ($204.4 million).

Country Garden said in early April that trading in its shares on the Hong Kong Stock Exchange was suspended.

— Shreyashi Sanyal, Reuters

China’s urban unemployment rate eases to 5%

China’s urban unemployment rate in April eased to 5%, down from March’s 5.2%.

The country’s National Bureau of Statistics did not provide age-wise data. It had said earlier that age-wise data will be made available after the overall numbers were released.

NBS said in a statement that the April figures were affected by the May 1 Labor Day holiday and last year’s high base.

“Major indicators of industry, exports, employment and prices improved overall, with new driving forces maintain[ing] rapid growth,” NBS said.

— Evelyn Cheng

China consumption slows in April, industrial activity remains robust

China’s April retail sales and fixed asset investment missed market expectations, while industrial production grew more than expected compared to the same period last year.

Retail sales rose by 2.3% in April from a year earlier, the National Bureau of Statistics said. That was less than the 3.8% increase forecast in a Reuters poll, and slower than the 3.1% pace reported in March.

Industrial production rose by 6.7% in April from a year ago, beating expectations for 5.5% growth, also substantially higher than 4.5% in March.

Fixed asset investment rose by 4.2% for the first four months of the year, missing estimates of a 4.6% increase.

—Evelyn Cheng

Singapore posts slower decline in non-oil domestic exports in April

Singapore’s non-oil domestic exports (NODX) fell 9.3% year on year in April, easing from a 20.8% plunge in March.

Data from Enterprise Singapore showed the decline was due to non-electronic goods such as pharmaceuticals, while electronics resumed growth.

The reading was better than Reuters’ poll estimate of a 10% drop.

NODX to Singapore’s biggest markets declined in April. Exports to the U.S. and the EU fell 40.6% and 55.1% respectively, compared with a 50.2% and 45.4% contraction in March.

— Shreyashi Sanyal

Japan’s central bank governor says there is ‘no immediate plan’ to sell ETF holdings: Reuters

Bank of Japan Governor Kazuo Ueda told parliament that the central bank has no immediate plans to sell its ETF holdings, according to Reuters.

“We must spend some time in deciding what to do with our ETF holdings, including whether to unload them in the future,” Ueda said.

In March, the BOJ dismantled its yield curve control policy and stopped its purchases of ETFs and Japanese REITs.

The BOJ has cumulative ETFs of 37.15 trillion yen ($238.92 billion), with an estimated market value of 71.3 trillion yen, according to financial information services website QUICK’s March report.

— Lim Hui Jie

CNBC Pro: BofA names ‘Asia’s most important stocks’ — and analysts give one over 40% upside

BofA Securities has screened for 20 of Asia’s “most important stocks,” selected from the constituents of the MSCI Asia Pacific Index.

Back-testing shows that the stocks on the investment bank’s screen “would have outperformed in 16 of the last 29 calendar years, and that they tend to outperform in rising markets.”

“In recent years, they would have meaningfully outperformed in 2019-20, but meaningfully underperformed in 2021-22. These are important stocks investors need to get right,” BofA’s analysts said, naming stocks on their screen.

— Amala Balakrishner

CNBC Pro: Meme stocks and more: Analyst names ‘danger zone’ companies to avoid

Meme stocks are in the spotlight this week.

GameStop, and others like AMC, experienced much volatility this week, rallying then tumbling after just two days.

Where do they go from here? One analyst names the stocks in “danger zone” list.

— Weizhen Tan

There’s still room for further upside for Big Tech stocks, Barclays says

Backed up by artificial intelligence-related tailwinds, the tech sector has largely led the current market rally. Shares of graphics processer manufacturer Nvidia are up 91% this year alone.

Despite this bull run, Barclays is still constructive on the sector.

“Big Tech fundamentals still look good here and we think there’s room to run over the next couple of quarters, even though the bar for the group to deliver has been set very high. Big Tech revisions have strengthened further post-Q1 earnings, bifurcating even more from the rest of the S&P 500,” strategist Venu Krishna wrote in a note.

Krishna added that the defensible margins that characterize the sector also have scarcity value in an increasingly troubling macroeconomic environment.

— Lisa Kailai Han

The S&P 500 is headed for the 5,575 level, Strategas’ Verrone says

The S&P 500 could next find support at the 5,575 level, according to Strategas head of technical and macro research Chris Verrone.

″[It’s] not exactly advanced math, but simple breakout technique suggests roughly 5550-5600 as the next S&P target,” Verrone wrote in a Thursday no

The S&P 500 has climbed about 12% this year.

The S&P 500 has gained more than 2% over the past week and nearly 12% in 2024.

— Brian Evans

U.S. may need unemployment to rise for ‘last mile’ of inflation fight, Bernanke paper says

New research authored by former Fed Chair Ben Bernanke and International Monetary Fund veteran Olivier Blanchard suggests that the U.S. and other countries may need unemployment to rise for inflation to fall back to normal levels.

The working paper, published by the Peterson Institute for International Economics, comes from a project in which 10 global central banks used a model developed by Bernanke and Blanchard to examine the pandemic-era inflation spike. The research showed that some period of higher unemployment and slower wage growth may be necessary to accomplish the “last mile” of reducing inflation.

“As the effects of relative price shocks and shortages stabilized or reversed, inflation declined, and the role of labor market tightness became increasingly important, suggesting that some slowing of activity might be necessary to get US inflation all the way back to target,” the paper’s abstract said.

The paper does say in its conclusion that “the unemployment costs of the last mile could be limited” in the U.S.

— Jesse Pound

Source : cnbc