- February 4, 2025

- By: Admin1_blog

- Asia Market, Indices

Amala Balakrishner

Asia-Pacific markets rose Tuesday after Donald Trump paused tariffs on Mexico for a month, while Canada also said the U.S. president had put on hold proposed tariffs on its exports.

Japan’s benchmark Nikkei 225 was trading 1.15% higher, while the broader Topix index advanced 1.06%.

South Korea’s Kospi rose 1.52% while the small-cap Kosdaq gained 3.09%.

Hong Kong’s Hang Seng index was trading up 2%.

Over in Australia, the S&P/ASX 200 was up 0.2%.

Indian stocks started the day higher, with the benchmark Nifty 50 up 0.62% while the BSE Sensex index rose 0.58%.

Chinese markets remain closed for the Lunar New Year holiday.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38858.17 | 338.08 | 0.88 |

| .HSI | Hang Seng Index | *HSI | 20500.45 | 283.19 | 1.4 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 8403.4 | 24 | 0.29 |

| .SSEC | Shanghai | *SHANGHAI | 3250.6 | -2.03 | -0.06 |

| .KS11 | KOSPI Index | *KOSPI | 2488.22 | 34.27 | 1.4 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 10072.55 | 133.78 | 1.35 |

Overnight in the U.S., stocks traded down following Trump’s decision to pause tariffs.

The Dow Jones Industrial Average recovered from steep losses during. The 30-stock index was down 122.75 points, or 0.28%, to close at 44,421.91. At its lows of the day, the Dow was down 665.6 points, or 1.5%.

The S&P 500 slid 0.76% to 5,994.57, while the Nasdaq Composite slumped 1.2% to 19,391.96.

— CNBC’s Sean Conlon and Pia Singh contributed to this report.

Shares of Japanese automakers rise after Trump delays tariffs on Mexico and Canada

Shares of Japanese automakers gained Tuesday, rebounding from the previous day’s losses after President Donald Trump suspended tariffs on Mexico and Canada for a month.

Japan-listed shares of Honda and Toyota added 1.79% and 2.81%, respectively. Nissan shares rose 1.91%. Mazda Motor, however, slumped 7.5%, a day after it posted downbeat results.

— Lee Ying Shan

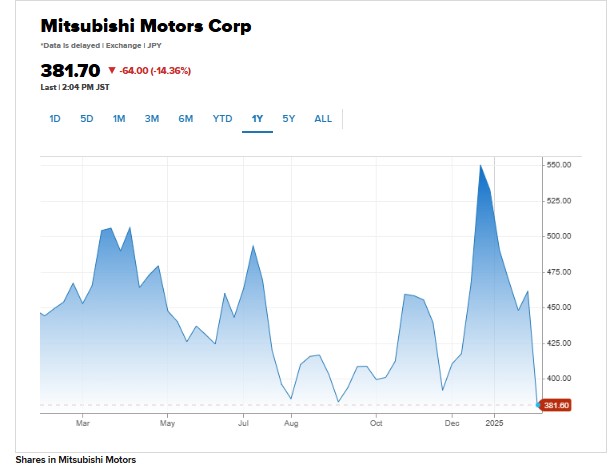

Shares in Mitsubishi Motors plunge over 15% on profit forecast cut, downbeat earnings

Shares in Mitsubishi Motors plunged as much as 15.25% Tuesday, a day after the Japanese automaker cut its full-year net profit forecast for FY2025 to 35 billion yen ($230 million) — 76% lower than the 144 billion yen it had penciled last May.

The revision comes amid expectations of lower sale volumes in Europe, Middle East, Latin America and Africa. The company is also anticipating higher operating expenses, it said in a regulatory filing Monday.

Its third-quarter net income came in at 33.2 billion yen, 69.6% down from the 102.8 billion yen the year before.

— Amala Balakrishner

CNBC Pro: How DeepSeek’s new AI models are already impacting profits at companies

China’s DeepSeek shook global stock markets after revealing that it had built a powerful artificial intelligence model for a mere $6 million.

While some have disputed the shockingly low cost of developing the AI models, most agree that DeepSeek has sharply cut the ongoing cost of running powerful AI models and the Chinese firm’s decision to release its technology for free has altered the course of the industry.

CNBC Pro spoke to Roadzen, a Nasdaq-listed firm attempting to disrupt the insurance sector, and OODA AI, a Sweden-listed AI service company, on how DeepSeek’s new AI models are set to impact their operations and financials.

— Ganesh Rao, Chloe Taylor

Stocks end Monday lower

The major stock averages closed lower to end Monday’s trading session.

The S&P 500 shed 0.76% to close at 5,994.57, while the tech-heavy Nasdaq Composite tumbled 1.20% and finished at 19,391.96. The Dow Jones Industrial Average lost 122.75 points, or 0.28%, to settle at 44,421.91.

— Lisa Kailai Han

5 out of 11 S&P 500 sectors trade higher on Monday

During Monday’s trading session, 5 out of the 11 S&P 500 sectors were trading in the positive.

The index was led higher by consumer staples and health care, each up around 0.5%. Energy and utilities stocks each added 0.4%.

On the other hand, information technology and consumer discretionary led the S&P 500 lower. The sectors respectively shed 1.4% and 1.2%.

— Lisa Kailai Han

Where the major averages stand

Here’s where the major averages stand heading into Monday’s close.

- The S&P 500 is down 0.34%

- The Dow Jones Industrial Average is up 0.08%

- The Nasdaq Composite is down 0.69%

- The Russell 2000 is down 1.01%

— Lisa Kailai Han

Tariffs could hurt economic growth, increase inflation, economists warn

Trump’s tariff plans could weigh on economic growth and cause inflation to jump, Wall Street economists warn.

Morgan Stanley economists estimate that “US Inflation could be 0.3 to 0.6pp higher vs baseline over the next 3-4 months (putting headline PCE inflation at 2.9% to 3.2%) and US growth could be -0.7 to -1.1pp lower vs baseline over the next 3-4 quarters (putting real GDP growth at 1.2% to 1.6%)” if tariffs are fully implemented and not temporary, strategist Michael Zezas said in a note to clients.

— Jesse Pound

Source : cnbc