- May 13, 2024

- By: Admin1_blog

- Asia Market, Indices

Lim Hui Jie

Asia-Pacific markets were mixed Monday as investors assessed China’s stronger-than-expected April inflation data.

China’s consumer price index climbed 0.3% year on year, beating Reuters estimates of a 0.2% rise.

The producer price index, however, fell 2.5% year on year, more than the estimated 2.3% drop.

The data highlight for the week will be Japan’s first-quarter GDP, which is expected to have contracted an annualized 1.5%, according to a Reuters poll, likely jeopardizing the Bank of Japan’s plans to raise interest rates.

India’s inflation figures will also be out late Monday, with economists polled by Reuters expecting inflation in the world’s fifth largest economy to slow slightly to 4.8% in April, down from March’s 4.85%.

Japan’s Nikkei 225 and the broad-based Topix pared earlier declines to trade flat.

South Korea’s Kospi was down 0.20%, while the small-cap Kosdaq fell 1%.

The Australian S&P/ASX 200 lost 0.2%.

Hong Kong’s Hang Seng index reversed earlier declines to rise 0.4%, while mainland China’s CSI 300 index was trading flat.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38058.84 | -170.27 | -0.45 |

| .HSI | Hang Seng Index | *HSI | 19052.14 | 88.46 | 0.47 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7724 | -25 | -0.32 |

| .SSEC | Shanghai | *SHANGHAI | 3151.94 | -2.61 | -0.08 |

| .KS11 | KOSPI Index | *KOSPI | 2715.12 | -12.51 | -0.46 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9517.57 | 4.51 | 0.05 |

On Friday in the U.S., the Dow Jones Industrial Average notched an eighth consecutive winning session and registered its best week of 2024. The 30-stock index added 0.32% during the session.

The S&P 500 climbed 0.16% and the Nasdaq Composite inched lower by 0.03%.

Consumer sentiment data released Friday morning showed a big uptick in inflation expectations, reining in Investor enthusiasm.

The preliminary May reading for the University of Michigan’s consumer sentiment index came in at 67.4, far below a Dow Jones estimate of 76 and marking its lowest reading in about six months.

— CNBC’s Pia Singh and Sarah Min contributed to this report.

China reportedly moves ahead with plans to sell long-term bonds worth $138 billion

China has reportedly begun plans to sell one trillion yuan ($138.24 billion) of ultra-long-term bonds, according to reports by the Financial Times and Reuters.

The Financial Times said that the People’s Bank of China “has asked brokers for advice on pricing the sale of the first batch of the sovereign bonds.”

Meanwhile, Reuters said the bonds will be issued from May 17, citing sources that said there would be 300 billion yuan worth of 20-year bonds, 600 billion yuan worth of 30-year bonds and 100 billion worth of 50-year bonds.

These ultra long term bonds were announced in March, and are designed to fund major projects aligned with national strategies.

These bonds have only been issued thrice before, during the Asian Financial Crisis in 1998, for the capitalization of China Investment Corporation in 2007 and during the Covid-19 pandemic in 2020.

— Lim Hui Jie

Shein reportedly boosts London IPO preparations amid U.S. hurdles

China’s Shein is boosting its preparations to go public in London following an attempt to list in New York that was hit by regulatory challenges, Reuters reported, citing sources with knowledge of the matter.

The fast-fashion retailer is planning to file documents with the London Stock Exchange (LSE) as early as this month and will update China’s securities regulator of the IPO venue, according to the report.

Shein filed to go public in the U.S. in late November, valued at $66 billion.

— Shreyashi Sanyal, Reuters

Australian government expects central bank’s inflation target will be met by year-end

The Australian government expects inflation to be in the Reserve Bank of Australia’s 2%-3% target range by the end of 2024, Reuters reported.

“We’re making progress in the fight against inflation, but it’s not mission accomplished because people are still under the pump and that’s why inflation’s a big focus of the Budget,” said Jim Chalmers, Treasurer of Australia in a media interview on Sunday.

Australia’s government is set to announce the federal budget on Tuesday.

— Shreyashi Sanyal, Reuters

China’s April inflation comes in slightly higher than expected

Consumer prices in China rose at a faster pace than expected, with the consumer price index in April recording a 0.3% increase year-on-year, data from the National Bureau of Statistics on Saturday showed.

This was higher than the 0.2% forecast by a Reuters poll of economists, and more than the 0.1% rise seen in March.

Separately, China’s producer price index fell 2.5% compared to April last year, compared to a 2.8% decline in the previous month.

— Lim Hui Jie

CNBC Pro: This global stock could rally 140% on a hydrogen fuel boom, analyst says

A global company specializing in tank facilities and refueling technologies could see its stock price soar by as much as 140% over the next 12 months, according to one analyst.

The company’s business model assumes buses, industrial trucks, and trains will likely use hydrogen in the future, rather than mass-market cars, which are now primarily transitioning towards electric power.

The analyst believes it’s perfectly positioned to capture the rapid rise in new hydrogen refueling stations being built over the medium term.

— Ganesh Rao

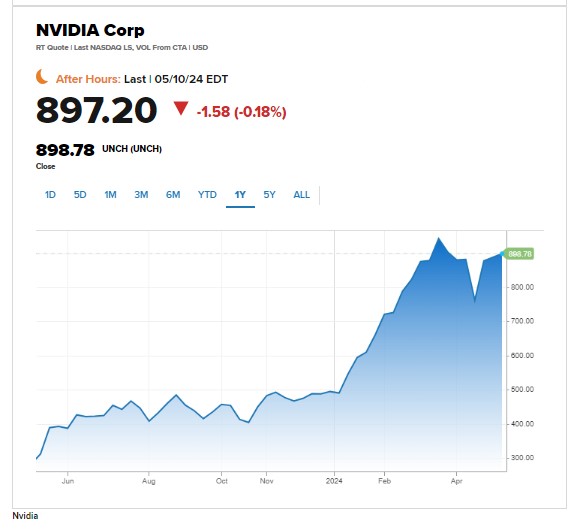

CNBC Pro: Buy Nvidia stock now or wait for another drop? Two fund managers disagree

Chipmaker Nvidia has dominated headlines over the past year, especially after its shares logged an astronomical 240% rise in 2023.

Its popularity shows little sign of abating, and although the stock was flat last week, it is still up by nearly 80% over the year to date.

The substantial rise in Nvidia’s share price has, however, raised questions about whether those not already invested should buy the stock now, or wait to see if its price drops.

— Amala Balakrishner

Goldman Sachs reaches all-time high, gains for 4th straight week and climbs 17% during that span

Goldman Sachs, the largest investment bank in the U.S., touched a record $458.75 on Friday before ending the week 3.8% higher.

Goldman has now risen for four straight weeks, climbing almost 17% during that span and single-handedly adding 431 points to the Dow Jones Industrial Average during the same period.

Looked at another way, Goldman Sachs has accounted for some 31% of the entire 1,405-point gain in the Dow Industrials over the past four weeks.

— Scott Schnipper

Fed officials say they are in ‘wait-and-see mode’ on interest rates

Federal Reserve regional presidents Neel Kashkari of Minneapolis and Austan Goolsbee of Chicago said they are taking a patient approach to monetary policy as they weigh surprisingly strong inflation data this year.

“I’m in a wait-and-see mode. Let’s get a lot more data to see if this inflation is going to continue or if it’s stalling,” Kashkari said during a joint live interview on CNBC. “We are all committed to getting inflation back” to the Fed’s 2% goal.

Goolsbee noted the rapid disinflation that occurred in 2023 and said he is hopeful that can resume following the sticky upward trend seen so far this year.

“I don’t like tying our hands even partially when we’re going to get a lot of data and important information before the next meeting much less for the rest of the year,” he said. “The data dogs need to do some sniffing and figure out, are we going to be on the path like what we saw last year where inflation fell almost as much as it has ever fallen in a year without a recession? Or did we kind of use up all of our good luck and this bump of the beginning of the year is actually a sign of overheating?”

— Jeff Cox

Consumer sentiment drops as inflation expectations jump

The University of Michigan’s consumer sentiment index dropped due in part to a big uptick in inflation expectations.

The index’s preliminary May reading came in at 67.4. That is well below a Dow Jones estimate of 76 and under the 77.2 reading for April.

“This 10 index-point decline is statistically significant and brings sentiment to its lowest reading in about six months,” Surveys of Consumers Director Joanne Hsu said in a statement.

“While consumers had been reserving judgment for the past few months, they now perceive negative developments on a number of dimensions. They expressed worries that inflation, unemployment and interest rates may all be moving in an unfavorable direction in the year ahead,” Hsu added.

Year-ahead inflation expectations jumped to 3.5% from 3.2%. Long-run estimates also went up to 31% from 3%.

— Fred Imbert

Source : cnbc