- March 4, 2025

- By: Admin1_blog

- Asia Market, Indices

Amala Balakrishner

Japanese stocks fell nearly 2% to lead declines in Asia-Pacific markets, after U.S. President Donald Trump made it clear that tariffs on Mexico and Canada would go into effect as planned.

The benchmark Nikkei 225 index plunged 1.69%, while the broader Topix index lost 0.96%.

Japan’s employment rate for January came in at 2.5%, slightly higher than Reuters’ estimates of 2.4%.

South Korea’s Kospi index was flat in choppy trade, while the small-cap Kosdaq retreated 0.75%.

The country’s retail sales for January fell 0.6% from the previous month. Revised estimates show a rise in the 0.2% rise in the metric in December.

Hong Kong’s Hang Seng index was down 0.46%.

Investors will be keeping a watch on Chinese stocks ahead of the country’s annual parliamentary gathering, known as the “Two Sessions.” Mainland China’s CSI 300 index dipped 0.25%.

Australia’s S&P/ASX 200 was trading 0.56% lower in its last hour of trade.

The country’s retail sales for January rose 0.3% in line with Reuters estimates. Retail sales had declined 0.1% in December.

Indian’s benchmark Nifty 50 fell 0.24%, while the BSE Sensex index lost 0.21%.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 37207.3 | -578.17 | -1.53 |

| .HSI | Hang Seng Index | *HSI | 22969.22 | -37.05 | -0.16 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 8189.4 | -56.3 | -0.68 |

| .SSEC | Shanghai | *SHANGHAI | 3318.92 | 2 | 0.06 |

| .KS11 | KOSPI Index | *KOSPI | 2526.88 | -5.9 | -0.23 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 10272.25 | -33.41 | -0.32 |

Overnight in the U.S., all three major indexes fell as Trump reiterated that 25% levies on imports from Mexico and Canada would go into effect Tuesday stateside.

The S&P 500 fell 1.76% to end the day at 5,849.72. This marks its worst day since December and brings its year-to-date performance to a loss of about 0.5%. The Dow Jones Industrial Average dropped 649.67 points, or 1.48%, to finish at 43,191.24. The Nasdaq Composite slid 2.64% to close at 18,350.19, weighed down by Nvidia’s decline of more than 8%.

Shares in Seven & i Holdings plunge over 9% after it reportedly plans to reject Alimentation Couche-Tard’s takeover bid

Shares of Japan’s Seven & i Holdings plunged as much as 9.34% Monday, following reports by the Yomiuri newspaper that it plans to reject a takeover bid from Canadian convenience store operator Alimentation Couche-Tard.

Instead, Seven & i is looking to enhance its corporate value on its own, the report added.

The drop in its shares is a reversal from the uptick on Monday following reports that it was looking to appoint Stephen Hayes Dacus as president.

Dacus, who is currently the lead independent director at Seven & i Holdings’ retail group, will be taking over from Ryuichi Isaka who is stepping down. The company will make a formal decision at a board meeting.

— Amala Balakrishner

TSMC shares drop 2% as Trump says company to invest $100 billion in the U.S.

Shares in Taiwan Semiconductor Manufacturing Company lost more than 2% Tuesday, after U.S. President Donald Trump said the company would invest $100 billion in the U.S. to bolster chip manufacturing.

Trump said the investment was a “tremendous move by the most powerful company in the world.”

This brings TSMC’s total investment in the U.S. to $165 billion.

The new investment from TSMC, which supplies semiconductors to major companies including Nvidia and Apple, will bolster the Trump administration’s efforts aimed at making the U.S. an artificial intelligence hub.

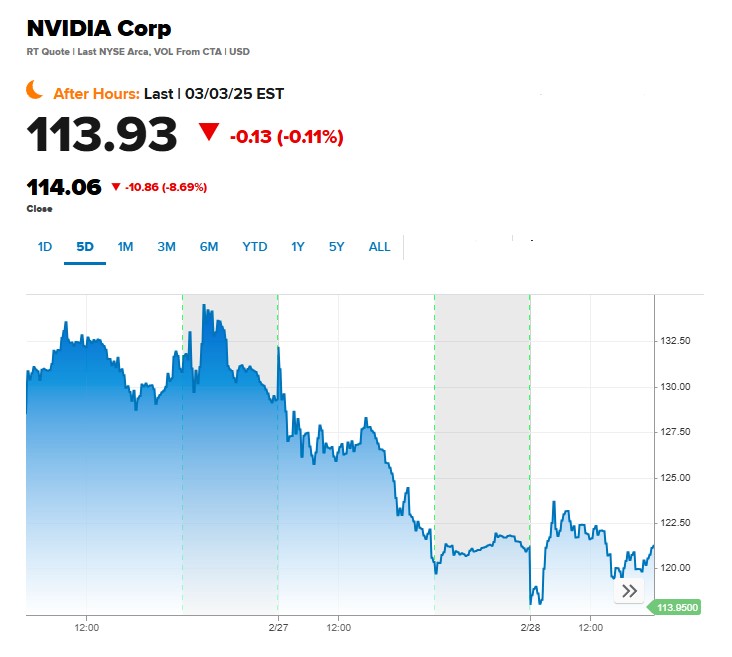

TSMC stock also took a hit from the drag in Nvidia’s shares, which fell 8.69% overnight.

— Amala Balakrishner

SoftBank shares fall over 5%

Shares of Japanese investment firm SoftBank Group fell as much as 5.81%, following the 8.69% fall of Nvidia’s shares overnight.

The drop in SoftBank’s shares is a reversal from the marginal uptick on Monday and comes after reports by The Information last Saturday that the company’s CEO Masayoshi Son planned to borrow $16 billion to invest in artificial intelligence.

SoftBank may borrow another $8 billion in early 2026, the report added.

Last month, CNBC reported that the company was close to finalizing a $40 billion primary investment in ChatGPT-owner OpenAI at a $260 billion pre-money valuation, as part of its vision to deepen its presence in the AI space.

— Amala Balakrishner

Trump tells Japanese and Chinese leaders they ‘can’t continue to reduce and break down your currency’

U.S. President Donald Trump told Japanese and Chinese leaders that they cannot devalue their currencies as it would be unfair to the U.S., according to Reuters.

“I’ve called President Xi, I’ve called the leaders of Japan to say you can’t continue to reduce and break down your currency,” Trump reportedly said on Monday.

“You can’t do it because it’s unfair to us. It’s very hard for us to make tractors, Caterpillar here, when Japan, China and other places are killing their currency, meaning driving it down,” he added.

The Japanese yen on Tuesday traded 0.07% lower at 149.43 against the U.S. dollar. Meanwhile, the offshore Chinese Yuan strengthened marginally by 0.04% to 7.3037 against the U.S. dollar.

— Amala Balakrishner

Japan reports unemployment of 2.5% in January, slightly higher than estimates

Japan’s unemployment rate for January edged up to 2.5% in January, compared with the 2.4% in the previous month, government data released Tuesday showed.

The latest reading is also slightly higher than Reuters poll estimate of 2.4%.

The country’s jobs-to-applicants ratio, came in at 1.26, slightly higher than the 1.25 forecast by Reuters.

— Amala Balakrishner

Nvidia falls more than 9%

AI darling Nvidia pulled back nearly 10% on Monday as the broader market sold off after President Trump confirmed tariffs on Canada, China and Mexico would begin on Tuesday.

Shares are continuing a slide from last week that was tied to margin concern.

Nvidia stock.

The Wall Street Journal reported on Sunday that Chinese buyers were finding ways to buy Nvidia’s chips despite Trump’s attempts to limit sales to Beijing.

— Brian Evans

Defensive stocks trade higher after Trump confirms tariffs

Defensive stocks took a leg higher Monday afternoon after President Trump confirmed Tuesday’s tariffs.

Shares of Philip Morris International added around 2%, while PepsiCo, Procter & Gamble and Johnson & Johnson all gained around 1%.

PM PEP PG JNJ intraday chart

This was in contrast to a broad risk-off move that sent stocks such as Broadcom and Ford lower.

— Lisa Kailai Han

Canada, Mexico ETFs fall

Exchange-traded funds tied to Mexico and Canada ETFs slid after President Trump’s confirmation of tariffs on both countries. Here is a snapshot.

- iShares MSCI Canada ETF (EWC) fell 2.1%

- iShares MSCI Mexico ETF (EWW) fell 0.9%

— Sarah Min

Source : cnbc.com