- February 3, 2025

- By: Admin1_blog

- Asia Market, Indices

Lee Ying Shan

Asia-Pacific markets traded lower Monday after U.S. President Donald Trump levied tariffs on Canada, Mexico and China over the weekend.

Australia’s S&P/ASX 200 dropped 1.61%.

Japan’s Nikkei 225 fell 1.99%, while the Topix lost 1.87%. South Korea’s Kospi dropped 2.52% and the small-cap Kosdaq traded 2.79% lower.

Hong Kong’s Hang Seng Index dropped 1.23% at the open.

India’s Nifty 50 fell 0.69% while the Sensex lost 0.88% at the open. India’s Union Budget over the weekend offered a huge income tax relief to the country’s middle class. The Indian government also pledged to reduce its fiscal deficit to 4.4% of its GDP for the year beginning April 1, a decrease from a revised 4.8% for the current year, amongst other measures.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38520.09 | -1052.4 | -2.66 |

| .HSI | Hang Seng Index | *HSI | 20140.74 | -84.37 | -0.42 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 8379.4 | -152.9 | -1.79 |

| .SSEC | Shanghai | *SHANGHAI | 3250.6 | -2.03 | -0.06 |

| .KS11 | KOSPI Index | *KOSPI | 2453.95 | -63.42 | -2.52 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9919.36 | -264.85 | -2.6 |

Chinese markets remain closed for the Lunar New Year holiday.

Caixin/S&P Global services manufacturing activity data for China will be released later in the day. The PMI is expected to come in at 50.5, according to Reuters poll estimates.

On Saturday, Trump signed an order implementing a 25% tariff on imports from Mexico and Canada, and a 10% tariff on goods from China. Energy exports from Canada will face a reduced 10% tariff, which are set to come into effect on Tuesday stateside.

The U.S. conducts around $1.6 trillion in annual business with these three countries combined.

Last Friday in the U.S., the three major averages closed lower. The S&P 500 shed 0.50% to end at 6,040.53, while the Dow Jones Industrial Average tumbled 337.47 points, or 0.75%, weighed down by a decline in Chevron. The 30-stock Dow ended the session at 44,544.66. The tech-heavy Nasdaq Composite slipped 0.28% to 19,627.44.

—CNBC’s Lisa Kailai Han, Alex Harring and Tanaya Macheel contributed to this report.

Alibaba shares reverse course to drop nearly 4% as investors digest Trump tariff impact

Shares of Alibaba reversed course to fall nearly 4% Monday after rising as much as 5.2% as the Hong Kong market resumed trading after a three-day break. The company’s American Depositary Receipts had dropped over 3.8% Friday.

Alibaba had released a new version of its Qwen 2.5 artificial intelligence model, when markets were closed last Wednesday, which it claims is superior to the DeepSeek-V3.

Tech stocks globally have been under pressure from Chinese AI startup DeepSeek’s capabilities in artificial intelligence.

Other Chinese tech stocks, however, were showing weakness, with shares in e-commerce player Meituan down 3.78%, while Tencent lost 0.2%.

— Amala Balakrishner

TSMC and Foxconn shares slump as trading resumes in Taiwan after holiday

Shares of Taiwan Semiconductor Manufacturing Company listed in Taiwan fell as markets resumed trading after the holidays following a selloff in AI-related stocks last week.

The market was shaken by news of a new AI model from Chinese startup DeepSeek, which nearly matched the capabilities of top U.S. developers. Trump tariff announcements have also soured market sentiment.

TSMC shares fell 6.17% at the open, while shares of Hon Hai Precision Industry lost over 7%.

— Lee Ying Shan

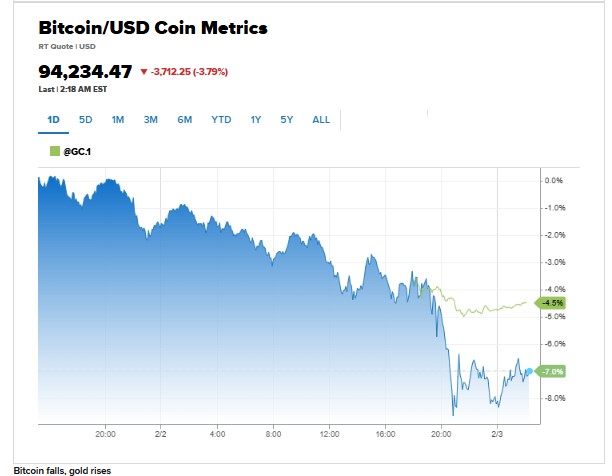

Bitcoin dips below $97,000 after Trump levies tariffs; other cryptocurrencies also tumble

Cryptocurrencies tumbled in a risk-off move after President Donald Trump hit Canada, Mexico and China with long-threatened import tariffs.

The price of bitcoin was last lower by 3%, according to Coin Metrics, a modest loss compared to the broader crypto market. Earlier, it fell as low as $96,202.42. The U.S. dollar index, which has an inverse relationship with bitcoin, was up nearly 1%.

The CoinDesk 20 index, which measures the largest 20 digital assets by market cap, dropped 9%. Ether slumped to its lowest level since November.

— Tanaya Macheel

Bank of Japan weighed more rate hikes in its last policy meeting

Bank of Japan officials discussed additional interest rate hikes in the last policy meeting, citing warnings over inflation risks and the economic impact of a weak yen, a summary of opinions from the bank’s January meeting showed.

“If economic activity and prices remain on track, it will be necessary for the Bank to continue to raise the policy interest rate accordingly,” the statement showed.

One BOJ member suggested that it was necessary to keep raising interest rates to avoid further depreciation of the yen and to prevent the “overheating” of financial activities.

— Lee Ying Shan

Bitcoin falls, gold rises in risk-off move after U.S. tariffs

Traders appeared to search for safety in early Sunday night trading after the U.S. hit key trade partners with hefty tariffs on goods.

Bitcoin dipped back below $100,000, losing 3.6% to trade at $97,554.24. Gold, a traditional safe-haven asset, ticked 0.3% higher to $2,842.60 per ounce.

— Fred Imbert

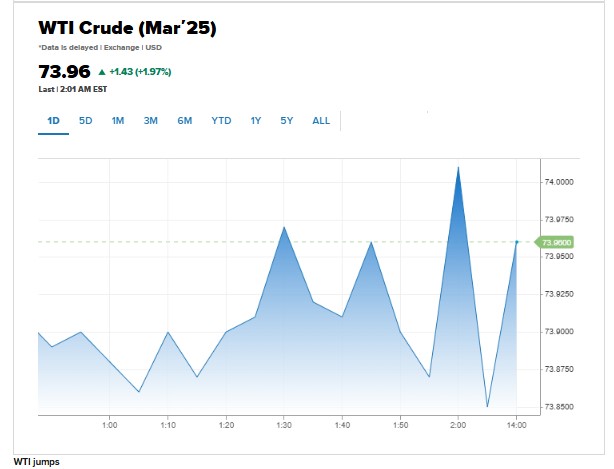

Oil prices pop after U.S. hits Mexico, Canada and China with tariffs

Oil prices began Sunday trading higher after the U.S. slapped tariffs on goods from China, Canada and Mexico — all key trading partners.

West Texas Intermediate futures were up 2% at $74.20 per barrel. International Brent crude climbed 1% to $76.42 per barrel.

— Fred Imbert

Stocks close Friday’s session in the red

After a volatile session, stocks ultimately ended Friday lower.

The S&P 500 shed 0.50%, closing at 6,040.53, while the tech-heavy Nasdaq Composite slipped 0.28% and finished at 19,627.44. The Dow Jones Industrial Average dipped 337.47 points, or 0.75%, and closed at 44,544.66.

— Lisa Kailai Han

Source : cnbc