- August 5, 2024

- By: Admin1_blog

- Asia Market, Indices

Lim Hui Jie

Key Points

- Heavyweight trading houses such as Mitsubishi, Mitsui and Co, Sumitomo and Marubeni all plunged more than 10%.

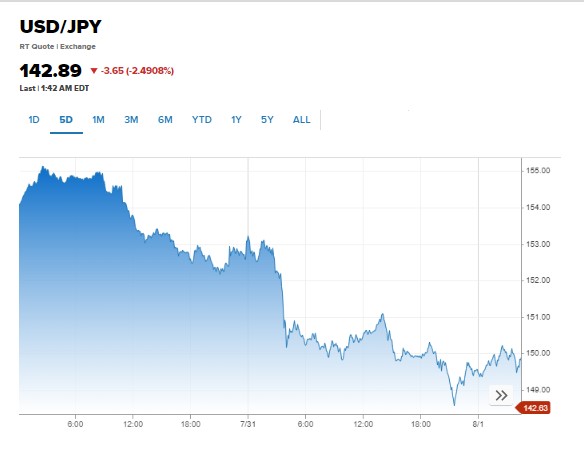

- The yen also strengthened to its highest level against the dollar since January, and was last trading at 143.40.

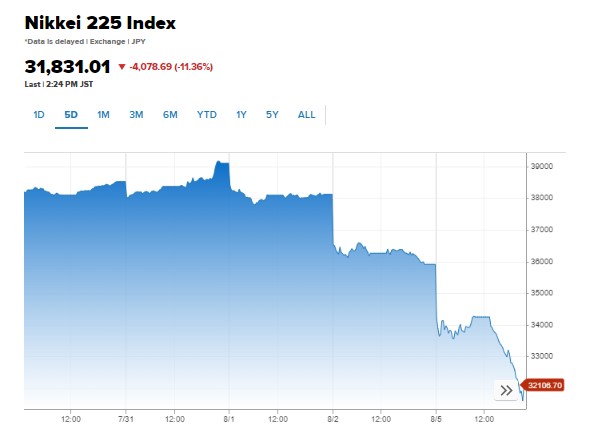

Japan stocks confirmed a bear market on Monday as Asia-Pacific markets continued the sell-off from last week, with the Nikkei 225 and Topix dropping over 10%.

The benchmark indexes have fallen more than 20% from their all-time highs on July 11.

Heavyweight trading houses such as Mitsubishi, Mitsui and Co, Sumitomo and Marubeni all plunged around 10%.

Monday’s decline follows Friday’s rout when Japan’s Nikkei 225 and Topix fell more than 5% and 6%, respectively. The broader Topix marked its worst day in eight years, while the Nikkei marked its worst day since March 2020.

In Monday trading, the yen also strengthened to its highest level against the dollar since January, and was last trading at 143.40.

Investors, meanwhile, awaited key trade data from China and Taiwan this week, as well as central bank decisions from Australia and India.

China’s service sector expanded at a faster pace in July, with the country’s purchasing managers’ index climbing to 52.1 in July, up from 51.2 in June.

The Caixin survey said the acceleration of growth was due to faster new business growth, “supported by sustained improvements in underlying demand conditions and an expansion of services offerings.”

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 32121.33 | -3788.37 | -10.55 |

| .HSI | Hang Seng Index | *HSI | 16674.65 | -270.86 | -1.6 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7666.7 | -276.5 | -3.48 |

| .SSEC | Shanghai | *SHANGHAI | 2883.25 | -22.08 | -0.76 |

| .KS11 | KOSPI Index | *KOSPI | 2459.81 | -216.38 | -8.09 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 8936.71 | -553.24 | -5.83 |

Taiwan’s benchmark index, the Taiwan Weighted Index, was down almost 8%, while Australia’s S&P/ASX 200 fell 3.05%.

The Reserve Bank of Australia kicks off its two-day monetary policy meeting Monday. Economists polled by Reuters expect the central bank to hold rates steady at 4.35%, but markets will monitor the monetary policy statement for clarity on whether the RBA is still considering a rate hike.

South Korea’s Kospi was down 6.66%, while the Kosdaq fell 6.78%.

Hong Kong Hang Seng index saw the smallest loss in Asia, down 0.22%, while mainland China’s CSI 300 was up 0.24%, the only major index in positive territory.

On Friday in the U.S., stocks fell sharply as a much weaker-than-anticipated jobs report for July ignited worries that the economy could be falling into a recession.

The Nasdaq was the first of the three major benchmarks to enter correction territory, down more than 10% from its record high. The S&P 500 and Dow were 5.7% and 3.9% below their all-time highs, respectively.

The S&P 500 dropped 1.84%, while the Nasdaq Composite lost 2.43%. The Dow Jones Industrial Average fell 610.71 points, or 1.51%.

Source : cnbc