- May 21, 2024

- By: Admin1_blog

- Asia Market, Indices

Lim Hui Jie

Asia-Pacific markets slid on Tuesday, breaking ranks with Wall Street that saw the Nasdaq hit record highs overnight on the back of tech rally.

Nvidia shares gained more than 2% on multiple bullish analyst calls that highlighted the company’s preeminent market position.

Several Wall Street firms also raised their price target on the AI darling ahead of its earnings report, suggesting shares could gain as much as 30% from their current levels.

Investors in Asia will be watching for any spillover effect on companies linked with Nvidia’s value chain, such as Taiwan’s TSMC and Foxconn, as well as South Korea’s Samsung Electronics and SK Hynix.

South Korea’s Kospi was down 0.34%, while the small-cap Kosdaq lost 0.15%.

Japan’s stocks reversed earlier gains, with the Nikkei 225 down 0.1% and the broad-based Topix 0.11% lower.

Australia’s S&P/ASX 200 slipped 0.17% as investors assessed the minutes of its central bank May meeting, which revealed the RBA considered raising rates due to higher inflation risks.

Hong Kong’s Hang Seng index shed 0.86%, while the CSI300 on mainland China dropped 0.24%.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 38994.19 | -75.49 | -0.19 |

| .HSI | Hang Seng Index | *HSI | 19275.54 | -360.68 | -1.84 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7852.6 | -11.1 | -0.14 |

| .SSEC | Shanghai | *SHANGHAI | 3162.61 | -8.53 | -0.27 |

| .KS11 | KOSPI Index | *KOSPI | 2721.46 | -20.68 | -0.75 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9769.89 | -70.7 | -0.72 |

Overnight in the U.S., the Dow Jones Industrial Average lagged the broader market, as JPMorgan Chase slumped.

Shares of JPMorgan declined 4.5% as CEO Jamie Dimon signaled during the bank’s annual investment meeting that his retirement may be sooner than previously stated. Dimon also said the bank would not buy back shares at their current levels.

The tech-heavy Nasdaq gained 0.65% to close at a record 16,794.87. The 30-stock Dow fell 0.49%, while the broad market S&P 500 inched up 0.09%.

— CNBC’s Lisa Kailai Han and Hakyung Kim contributed to this report.

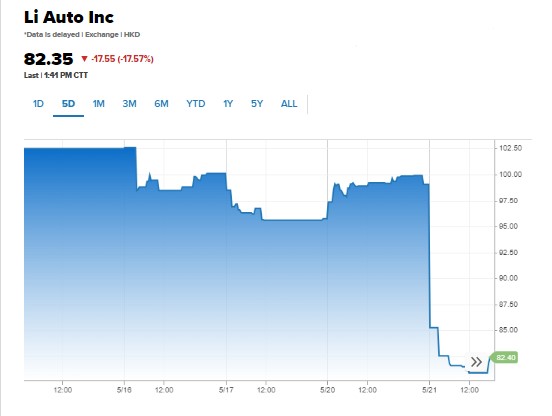

Li Auto plunges to 14-month low after downbeat first-quarter results

Shares of Chinese electric vehicle maker Li Auto plunged as much 25% on Tuesday after the EV maker posted downbeat first-quarter results.

The stock was the biggest loser on the Hang Seng index following its steepest one-day drop since March 2022.

Li Auto reported revenue of 25.6 billion yuan ($3.5 billion), down 38.6% from the fourth quarter of 2023, but 36.4% higher year on year. Revenue missed analysts’ average estimate of 26.73 billion yuan.

Vehicle deliveries in the first quarter also tumbled to 80,400 from 131,805 in the last quarter of 2023.

— Lim Hui Jie

Australia’s central bank considered raising rates in May meeting, minutes show

The Reserve Bank of Australia considered raising rates in its May meeting, minutes of the central bank’s meeting showed.

Members noted that inflation in Australia had declined less than expected, and economic growth and inflation internationally was exceeding expectations.

The RBA board members also agreed that economic information since the April meeting had increased the risks of inflation staying above target for longer.

RBA, however, left the cash rate unchanged at 4.35%.

— Lim Hui Jie

Samsung Electronics reportedly names new chief for semiconductor unit

South Korean chip giant Samsung Electronics has named Young Hyun Jun as its new chief for the semiconductor unit, Reuters reported Tuesday.

Samsung said the move was a “preemptive measure to strengthen the future competitiveness,” according to the report.

Jun has been chief executive at Samsung’s battery arm, Samsung SDI.

— Lim Hui Jie, Reuters

CNBC Pro: U.S. tariff hikes on China EVs will benefit these global stocks, Bernstein says

The U.S move to impose higher tariffs on Chinese electric vehicles is set to have an impact on the U.S. battery supply chain — and create investing opportunities, according to Bernstein.

Those tariffs will benefit the U.S. battery supply chain, where demand is expected to grow at a compound annual growth rate of 25% to 30%, according to Bernstein in a May 13 note.

It names global stocks that investors can consider.

— Weizhen Tan

CNBC Pro: Outperforming value investor names ‘very cheap’ global gaming stock as a ‘contrarian’ bet

Shares of a global video game developer are currently being overlooked by the market and are up for grabs at a “very cheap” price, according to Schroders fund manager Vera German.

The company’s shares have been hit hard over the past few years, with the stock price declining significantly from its peak in 2021. It has fallen by 40% over the past 12 months alone.

The value investor believes that the company is well-positioned for future growth as it has a net cash of $1.1 billion and a strong cash flow generation.

— Ganesh Rao

Commodities still a risk to market, Raymond James says

Commodities are still the biggest threat to the U.S. stock market, according to Raymond James managing director Tavis McCourt.

“Commodity prices remain the biggest ‘risk to the bull’ in the U.S. this year,” McCourt told clients in a Sunday note.

He noted that disinflation will be tough if commodity prices continue to rally. McCourt also said further price increases can push global portfolio managers to shift back to emerging markets and commodity-focused indexes after pouring money into the U.S. market.

— Alex Harring

Jamie Dimon indicates his retirement is coming

JPMorgan Chase CEO Jamie Dimon indicated Monday that the day is getting closer when he still step down from running the nation’s largest bank.

“The timetable isn’t five years anymore,” the 68-year-old chief executive said during the bank’s annual investor day. The comments, reported by The Wall Street Journal, are a bit of a switch from the way he generally brushes off questions about his future.

There are multiple potential successors, with the next CEO expected to come from within. JPMorgan shares were off 2.5% in afternoon trading.

— Jeff Cox

Fed’s Jefferson says inflation has fallen ‘nowhere near as quickly’ as he’d like

Federal Reserve Vice Chair Philip Jefferson on Monday emphasized that inflation is not cooling quickly enough to warrant interest rate reductions.

While he said the pace of price increases has “eased dramatically” from its mid-2022 peak, Jefferson added that he supported the recent Federal Open Market Committee decision to hold rates steady.

“I believe that our policy rate is in restrictive territory as we continue to see the labor market come into better balance, and inflation decline although nowhere near as quickly as I would have liked,” Jefferson said in prepared remarks for a speech in New York.

Of particular note, Jefferson said Fed economists have calculated that core inflation, as measured by the central bank’s preferred personal consumption expenditures price index, rose at a 4.1% annual pace in the first four months of 2024, above the 2% target.

— Jeff Cox

Source : cnbc