- May 20, 2024

- By: Admin1_blog

- Asia Market, Indices

Lim Hui Jie

Asia-Pacific markets mostly rose Monday, tracking Wall Street gains, as investors await economic data from across the region this week.

China held its one- and five-year loan prime rates unchanged at 3.45% and 3.95%, respectively, after the country laid out measures on Friday to boost its property market. The five year LPR is the reference rate for housing mortgages.

Hong Kong’s Hang Seng index rose 0.51% after the announcement, while the mainland Chinese CSI300 gained 0.42%.

Investors await trade, inflation and business activity data out from Japan later this week, while Singapore will release its April inflation data and final figures for its first-quarter gross domestic product.

Japan’s Nikkei 225 climbed 1.5%, while the broad-based Topix gained 1.21%.

South Korea’s Kospi rose 1.09%, but the small-cap Kosdaq slipped 1.02%. The country’s central bank will release its rate decision later this week on Thursday.

Investors will also keep an eye on Taiwan as Lai Ching-te takes over formally as the island’s new president, with the Taiwan Weighted Index up marginally.

The Australian S&P/ASX 200 advanced 0.59%.

| TICKER | COMPANY | NAME | PRICE | CHANGE | %CHANGE |

|---|---|---|---|---|---|

| .N225 | Nikkei 225 Index | *NIKKEI | 39069.68 | 282.3 | 0.73 |

| .HSI | Hang Seng Index | *HSI | 19677.88 | 124.27 | 0.64 |

| .AXJO | S&P/ASX 200 | *ASX 200 | 7864.4 | 50 | 0.64 |

| .SSEC | Shanghai | *SHANGHAI | 3174.02 | 19.99 | 0.63 |

| .KS11 | KOSPI Index | *KOSPI | 2738.1 | 13.48 | 0.49 |

| .FTFCNBCA | CNBC 100 ASIA IDX | *CNBC 100 | 9849.97 | 63.93 | 0.65 |

On Friday in the U.S., the Dow Jones Industrial Average closed Friday above the key 40,000 level for the first time.

The Dow first hit the 40,000 level during Thursday’s trading session, but cinched its first close over the threshold a day later when it added 134.21 points, or 0.3%, to end at 40,003.59.

The S&P 500 inched 0.1% higher Friday, while the Nasdaq Composite slipped by less than 0.1%.

This market rally should continue at least in the short term, according to Tom Lee, head of research at Fundstrat Global Advisors. Lee highlighted Microsoft Build event from Tuesday to Thursday stateside, and Nvidia’s fiscal first-quarter results due Wednesday as potential catalysts.

— CNBC’s Lisa Kailai Han contributed to this report.

Taiwan’s new President takes office, calls on China to cease political and military intimidation

Taiwan’s new president, Lai Ching-te, was sworn in on Monday, taking over from his predecessor Tsai Ing-wen after securing a victory in January’s election that ushered in an unprecedented third presidential term for the Democratic Progressive Party.

His vice president, 52-year-old Hsiao Bi-khim, a former de facto Taiwan ambassador to the United States, was also sworn in.

During his inauguration speech, Lai called on China to cease its political and military intimidation against Taiwan, adding that he hoped China would “face the reality of the Republic of China’s existence” and respect the choices of the people of Taiwan.

He also said: “Let us together pursue peace and mutual prosperity,” and called on China to choose “dialogue over confrontation, exchange over containment,.

— Lim Hui Jie, Sumathi Bala

Thailand economy grew 1.5% in the first quarter, faster than expected

Thailand’s first quarter gross domestic product expanded by 1.5% year on year, beating expectations of a 0.8% growth by economists polled by Reuters.

Still, the 1.5% expansion was slightly lower than the 1.7% growth seen in the fourth quarter of 2023. On a seasonally adjusted quarter-on-quarter basis, the economy expanded by 1.1%.

Thailand’s government data said the first quarter growth was mainly driven by “the robust growth of export of services and private consumption, along with the continual expansion of private investment.”

Growth accelerated in sectors like accommodation and food service activities, as well as the transportation and storage sectors.

— Lim Hui Jie

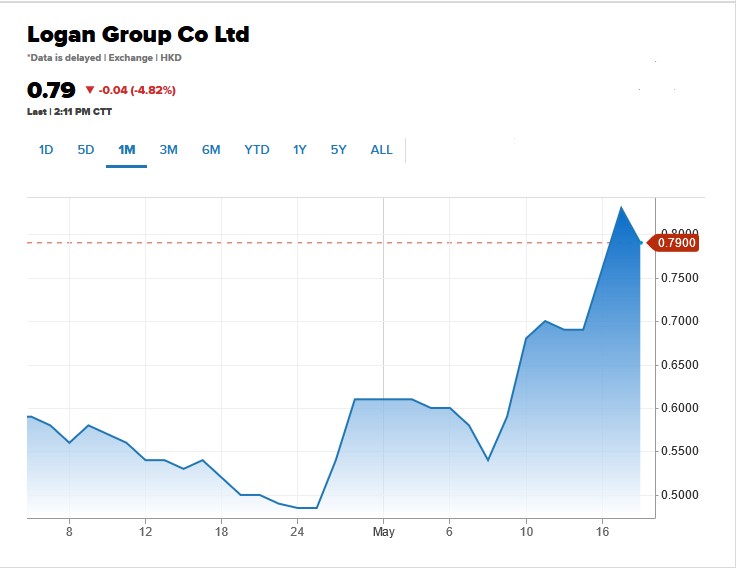

China property stocks drop after Friday’s rally

Shares of Chinese property developers in Hong Kong fell on Monday after wrapping up last week on a high note.

China’s central bank held its five-year loan prime rate steady at 3.95% on Monday. It acts as a key reference for property mortgages.

This comes after the world’s second-largest economy rolled out measures to boost its property market, including cutting down payments and removing the floor on minimum mortgage interest rates, sending real estate stocks soaring on Friday.

Logan Group and Cifi Holdings led declines on Monday, down 6.02% and 5.56%, respectively; Longfor Group was down 4.82%, while China Vanke

slid about 2%. The Hang Seng Mainland Property Index on inched 1.68% lower.

— Lim Hui Jie

China leaves loan prime rates unchanged

China’s central bank left its one- and five-year loan prime rates unchanged at 3.45% and 3.95%, respectively.

The one-year LPR is seen as the peg for most household and corporate loans, while the five-year rate is the benchmark for most property mortgages.

The decision was in line with a Reuters poll that expected both rates to stay unchanged.

China on Friday announced measures to boost its debt-laden property market.

— Shreyashi Sanyal

Dow closes at a record high above 40,000

The Dow Jones Industrial Average rose to another record close on Friday afternoon.

The 30-stock index rose 134.21 points, or 0.34%, to settle at 40,003.59. The benchmark had first crossed over the 40,000 mark for the first time on Thursday morning.

The S&P 500 also added 0.12% to close at 5,303.27. On the other hand, the Nasdaq Composite

shed 0.07%, finishing at 16,685.97.

— Lisa Kailai Han

The Fed will cut rates this year upon a ‘return of disinflation,’ UBS says

Softer economic data in recent weeks bolsters the argument that investors may finally receive some much-anticipated rate cuts in 2024, UBS argued in a Friday note.

“We continue to believe recent economic data underpin our view that a return of disinflation should allow the Fed to start easing policy later this year,” the bank wrote.

UBS added that price pressures have also been easing in recent months in categories such as shelter, which should help bring down overall inflation.

— Lisa Kailai Han

Stocks will experience near-term choppiness followed by a late-year rally, Wells Fargo says

Stocks have rallied to record highs recently, but Wells Fargo is expecting this trend to turn on its head.

Analyst Christopher Harvey pointed out that the “bad news = good news” narrative has pushed the major stock indexes to new records. However, he believes the market is unlikely to continue pushing higher consistently, at least for now.

“Expect near-term choppiness with a late-year rally toward our SPX 5535 target,” he wrote.

Harvey’s year-end S&P 500

target represents a 4.5% move upward for the benchmark.

— Lisa Kailai Han

Source : cnbc