- May 13, 2024

- By: Admin1_blog

- EU Market, Indices

Holly Ellyat

European markets are heading for a mixed open at the start of the new trading week, and investors will be keeping a close eye on the latest U.S. inflation figures.

April’s consumer price index report is due out on Wednesday, with traders hoping that a return to rate hikes is largely off the table for the U.S. Federal Reserve despite a slew of hotter-than-expected inflation prints recently.

Overnight, Asia-Pacific markets were mixed as investors assessed China’s stronger-than-expected April inflation data; China’s consumer price index climbed 0.3% year on year, beating Reuters estimates of a 0.2% rise.

India’s inflation figures will also be out late Monday, with economists polled by Reuters expecting inflation in the world’s fifth-largest economy to slow slightly to 4.8% in April, down from March’s 4.85%.

CNBC Pro: This global stock could rally 140% on a hydrogen fuel boom, analyst says

A global company specializing in tank facilities and refueling technologies could see its stock price soar by as much as 140% over the next 12 months, according to one analyst.

The company’s business model assumes buses, industrial trucks, and trains will likely use hydrogen in the future, rather than mass-market cars, which are now primarily transitioning towards electric power.

The analyst believes it’s perfectly positioned to capture the rapid rise in new hydrogen refueling stations being built over the medium term.

— Ganesh Rao

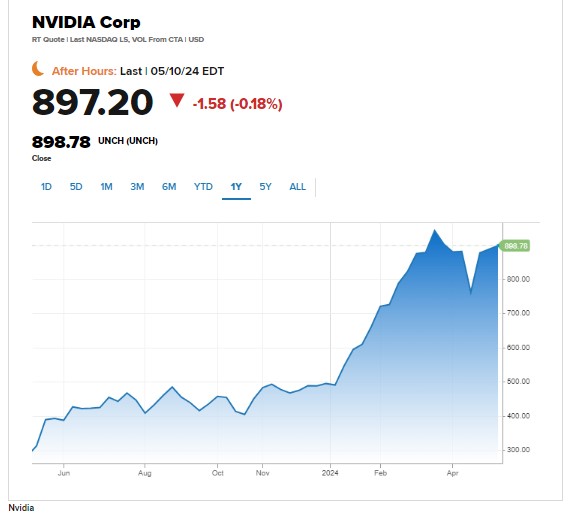

CNBC Pro: Buy Nvidia stock now or wait for another drop? Two fund managers disagree

Chipmaker Nvidia has dominated headlines over the past year, especially after its shares logged an astronomical 240% rise in 2023.

Its popularity shows little sign of abating, and although the stock was flat last week, it is still up by nearly 80% over the year to date.

The substantial rise in Nvidia’s share price has, however, raised questions about whether those not already invested should buy the stock now, or wait to see if its price drops.

— Amala Balakrishner

European markets: Here are the opening calls

European markets are expected to open in mixed territory Monday.

The U.K.’s FTSE 100 index is expected to open 15 points lower at 8,422, Germany’s DAX up 23 points at 18,781, France’s CAC 8 points higher at 8,201 and Italy’s FTSE MIB up 15 points at 34,332, according to data from IG.

Earnings are due from Ferrovial. There are no major data releases.

— Holly Ellyatt

Source : cnbc