Weekly Prize: Gold 5gr

SOEGEEFX APP FOR ALL TRADER

New T&C start April 1, 2024:

WELCOME BONUS $100 | Register and deposit initial margin $50 ( good fund in trading account ), get additional funds $100 to start real-trading.

Join Telegram Groups and Channels

- soegeefuturescommunity

- Sôegee Futures Public

Follow and Like Sôegee Futures Social Media Accounts

Instagram : Soegeefx

Facebook : Soegee Futures

Twitter : Soegeefx

TikTok : Soegeefxzero

If you have followed, screenshot and share on WhatsApp number 08111807172

Participate in Live Trade with Sôegee Futures via ZOOM which is held every day from 20.00 to finish with Open Camera.

You may cash-out your balance of bonus on the expiration date of bonus on the thirtieth day (30 days since bonus date) after minimum 2 lots Fx/Gold or 100 lots SingleStock-CFDs traded in your real-account, but if there's no minimum lot traded before the expiration date of bonus than bonus will be cancelled on the expiration date of bonus. You may withdraw your trading Profits (on top of $150 equity) after minimum 2 lots Fx/Gold or 100 lots SingleStock-CFDs traded in your real-account any working days from 09:00 - 20:00 WIB.

A global market trading account, best for spread trade strategy, as well as scalping, automated trading - Expert Advisor / Robot, Copy-trading and more …

Passive Income

Introduce us to your friends, get daily instant Referral/IB compensation $1 / lot closed-trade and to get more please contact [email protected]

TRADING BONUS $10 | Register and get cash bonus $10 for 1 lot Fx/Gold traded to profit more. You may cash-out your all bonus at the beginning of each following month

A global market trading account. All-in-one trade 6 different asset classes including 130+ instruments Forex pairs + Precious Metals + Energy + Global Indices + US, EU, HK Single Stock CFD.

Passive Income

Introduce us to your friends, get daily instant Referral/IB compensation $2 / lot closed-trade and to get more please contact [email protected]

Sôegee Futures is a brokerage company established in 2000, the leading Indonesia's best Forex Specialists, a real ECN Broker with open social trading networks to socialize and collaborate with traders from all around the world also provide various type of market analysis that caters for beginner, intermediate and advanced traders with technical actionable trading opportunities integrating into a comprehensive trading platform SoegeeFX Mobile app for our value customers.

Benefits from ultra-low raw spreads offer by Aggregated Liquidity Pool over 20 liquidity providers: banks and non-banks ECN trading network with FX spread as low as 0.00001, GOLD spread as low as 0.01 and low commissions.

All strategies are allowed, including scalping strategies and placing SL/TP orders inside the spread, position hedging as well as automated trading - Expert Advisor, Trade Signal, copy trading, trailing-stop and more …

We offer 6 different asset classes including 130+ instruments. All-in-one trade Forex pairs + Precious Metals + Energy + Indices + US, EU, HK Single Stock CFD + JFX Commodity Futures and more …

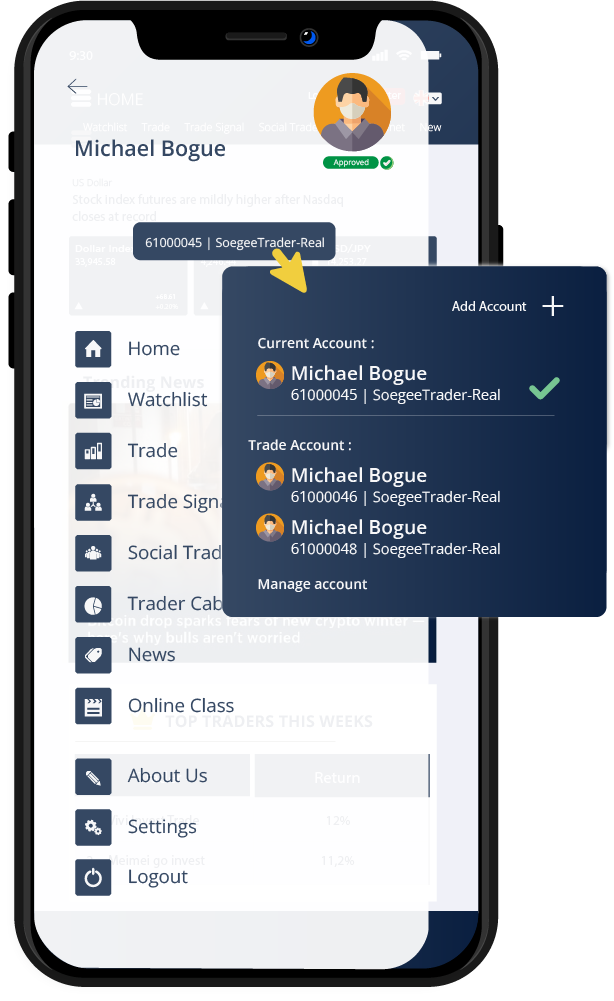

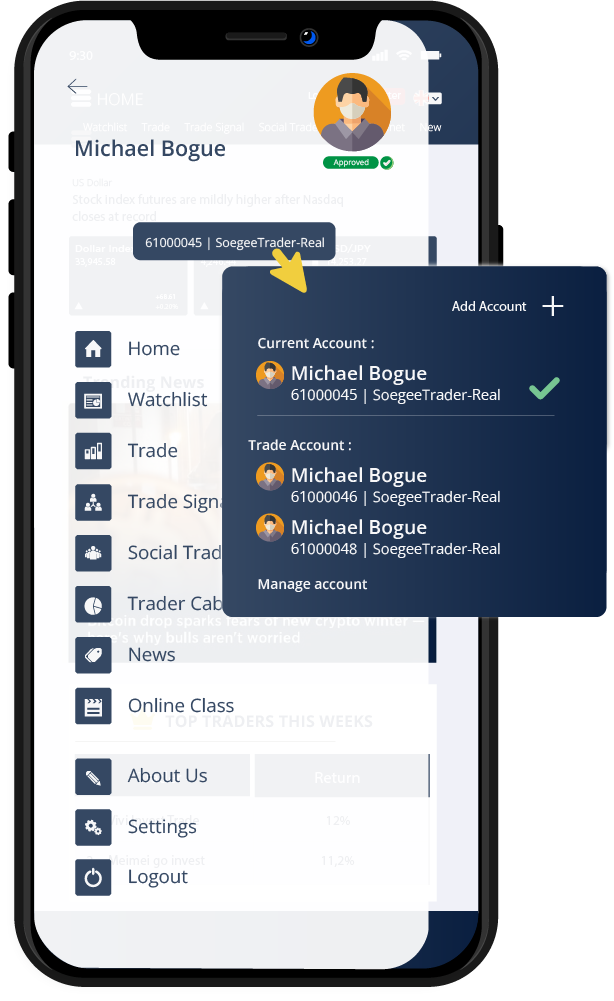

Sôegee Futures with new SoegeeFX Mobile app app maximizes the use of modern financial technology (Fintech) to make various aspects of financial services and Fx/Gold & Stock trading more efficient for customers with key features:

Our success is measured by results, the most important being how our clients feel about their experience with us. Happy customers and ongoing relationships are what we strive for. These reviews affirm that we’re onto something.

Sôegee Futures is a diligent, knowledgeable broker who puts the success of its clients foremost in every aspect of services. Sôegee Futures was the obvious choice to build a portfolio of global market products including JFX Commodity Futures. I also appreciate the fact that you can tell Sôegee Futures and its team have a strong knowledge and experience of all these exotic markets. I strongly recommend Sôegee Futures for global markets access and their excellent support.

I’ve robot-traded with copy-trade using three different brokers and I’m happiest (by far) trading at SoegeeFX. They have ultra-low FX spreads as low as 0.00001 and a level of service that others do not.

I have been following you for a month now on social media and I’m very much impressed. Your signals are excellent! Your service is amazing! By getting the Autochartist signals directly to my email in real time, I almost never miss a trade. Before I had your premium service, I also had some nice profits each month, but with the premium account, my profits just doubled! Thank you SoegeeFX team, keep up the good work.

Nymbi Social Trading platform is one of those tools that every trader should be using. With this easy to learn and find out what is happening in the markets now and share trading ideas, traders save time and money, so they can focus on main aspect of trading – make a more trade and more profit!

Thanks, SoegeeFX for providing such a great site. I can honestly say that the education I obtained after joining your blog in just a few short months has drastically helped me to become a more successful trader. I have gained more knowledge and experience in just a few months than the previous 18 months I spent with indicator-based systems because they just don’t teach support/resistance and trend lines as your site does. Thanks again.

Sôegee Futures has been my broker since 2018. In 2018, I opened an account with Sôegee Futures to trade forex & stock CFDs. Since I started trading this account, I have been extremely pleased with SoegeeFX platform, in terms of the number of instruments 100+ available for trading, raw spreads, low commission, ease and speed of use, as well as the reliability. Although many brokers offer great service, most offer only great excuses. Sôegee Futures actually delivers!

Whether you’re an active trader, a passive investor, or somewhere in between, this SoegeeFX Mobile app does everything you need to trade Fx/Gold & Stock with ultra-low raw spreads on over 6 different asset classes including 100 instruments. You can trade on the go with well designed mobile apps for Android and iOS.

You can test your trading skills and compete against other traders from around the country during the annual Nymbi Challenge. You'll build real-world experience and compete for real cash for trading, you compete for a chance to win prizes.

The competition, hosted by Nymbi™, is open to traders from Sôegee Futures – SoegeeFX, LabaFX Berjangka, PT., Gatra Megah Berjangka, PT – Money Mall, Teknologi Finansial Berjangka, PT., and start in Januari-to-December 2022.

Weekly Prize: Gold 5gr

Monthly Prize: Gold 10gr

Quarterly Prize: Gold 20gr

A list that provides answers to common questions asked by visitors to this Web site. For more information, please fill the Contact Form below or contact our Customer Service (Phone: +62 21 3911 138 or email add [email protected]).

We’ve already brought you our pick of the best podcasts, video series, and even online class to learn trade Fx/Gold & Stock with. Here are our top recommendations for learning trade Fx/Gold & Stock with a blog.

Holly Ellyatt

European markets are heading for a positive start to trading Tuesday as traders look ahead to a busy day of earnings reports in the region.

Read More

Gold prices climbed more than 1% on Monday, as the U.S. dollar weakened after softer-than-expected U.S. jobs data fueled expectations of potential interest rate cuts by the Federal Reserve later this year.

Read MoreLim Hui Jie

Asia-Pacific markets climbed on Tuesday, extending gains from the previous session, as Wall Street rose overnight on expectations that the Federal Reserve will cut interest rates.

Read MoreHolly Ellyatt

European markets are heading for a positive start to trading Tuesday as traders look ahead to a busy day of earnings reports in the region.

Read More

Gold prices climbed more than 1% on Monday, as the U.S. dollar weakened after softer-than-expected U.S. jobs data fueled expectations of potential interest rate cuts by the Federal Reserve later this year.

Read MoreLim Hui Jie

Asia-Pacific markets climbed on Tuesday, extending gains from the previous session, as Wall Street rose overnight on expectations that the Federal Reserve will cut interest rates.

Read MoreAs a regulated Indonesian broker, we offer transparency, segregated bank account for customer’s fund, dedicated 24/7 customer service and online class with training facility.

This will close in 0 seconds

the benefits of Social Trading

Nymbi™ offer Social Trading platform, a quick way to learn and find out what is happening in the markets now. Social trading works more or less like a social network. The only difference is that instead of sharing selfies or lunch photos, on a trading network people share trading ideas.